Amortising an existing loan

When forecasting an existing loan, there are two options.

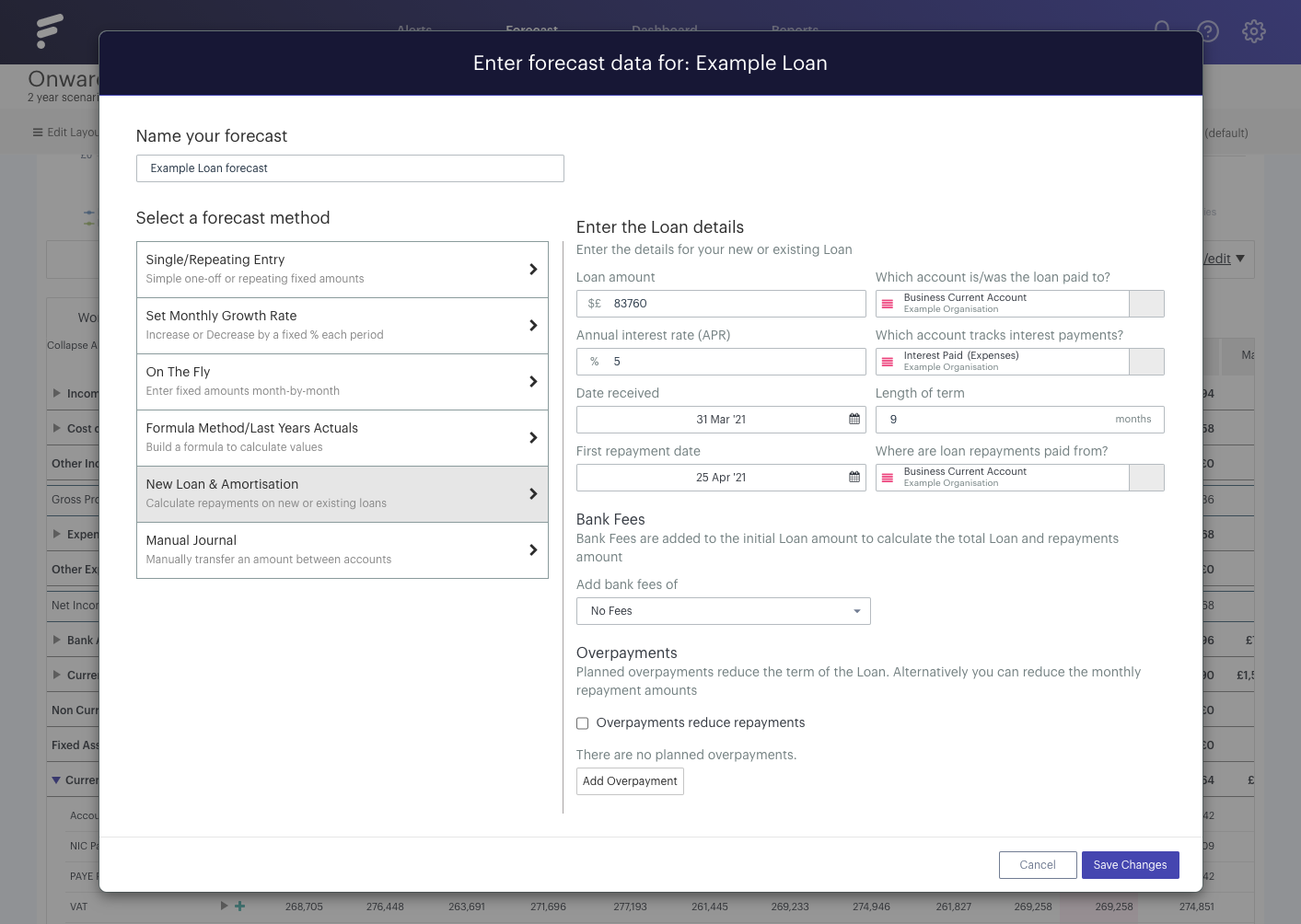

1) If you know the original loan details

If you have the full details for the original loan you can create a new loan forecast using those details, setting the appropriate dates in the past. The capital and interest repayments will continue from the date of your last actuals, and the result will be much the same as the above 'New loan' example.

2) If you don't have full details

If you're missing the full details of the original loan you can forecast the remaining repayments using the current balance. For this you'll need to know:

- The term remaining on the loan

- The outstanding balance

- The annual interest rate

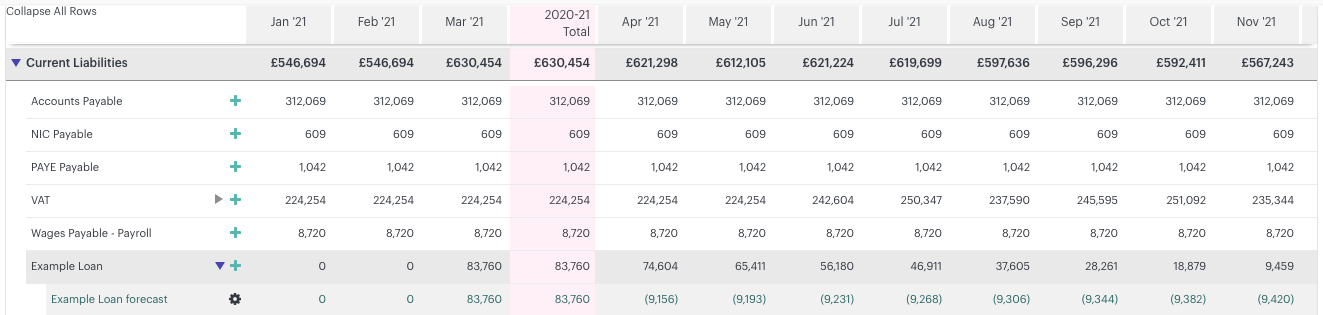

Using the above example, let's amortise our initial loan beginning in April. At this point, the outstanding balance taken from our loan account is 83,670 and we know there are 10 months remaining (as repayments began in February our loan end date will be next February).

We'll set the loan amount at the closing balance at the end of the last known period (31st March in this example):

As we can see, our loan is now amortised with the capital repayments matching the original loan:

It's always preferable to forecast loans using the original loan details as this ensures the calculations will accurate.