The loan wizard allows you to forecast the receipt, fees interest and repayment of a loan with a simple, convenient method. Using the loan wizard we can:

- Forecast a new loan

- Forecast ongoing commitments to an existing loan (amortisation)

- Track loan fees as an upfront or additional payment

- Record overpayments reducing the term or repayments

- - - - - -

Forecasting a new loan

If you're considering or already have committed to a new loan, you'll want to forecast the impact this has on your cash flow and bank balance over time.

When creating a new loan forecast you have to create it against any current liability account, not directly in the bank account where it's received.

Before you start you'll need to know:

- The loan amount, for example £100,000

- The annual interest rate, for example 5%

- The date the loan is received, for example 15th January

- The date at which repayments will begin, for example 25th Feb

- The length of term in months, for example 12 months

- Any fees paid, and if they are paid upfront or added to the loan

- - - - - -

Opening any forecast we'll locate our loan account within liabilities - this is the account we'll use to track the outstanding debt owed. Press the green '+' button next to the loan account and pick the 'New Loan & Amortisation' method.

Using our above example details we will fill in the loan details as follows. We'll need to select appropriate accounts for the following:

- Loan Paid To: Typically this will be your default bank account, but if you're receiving the loan in an alternative account you need to change this

- Interest tracking account: Interest will be paid out of the repayments bank account, but is tracked as a monthly expense. You'll need to select an appropriate account for this, most typically 'Interest Paid'

- Loan repayments account: This is the bank account used to track the repayments of capital and interest of the loan

This forecast will now show the 100,000 being paid to the Bank Account and tracked against the loan liability. Each month there is a forecasted payment of interest and capital repaid, with the end result of the loan being back, no outstanding liability and a deficit in the bank account equal to the total interest paid on the loan.

- - - - - -

Paying loan fees

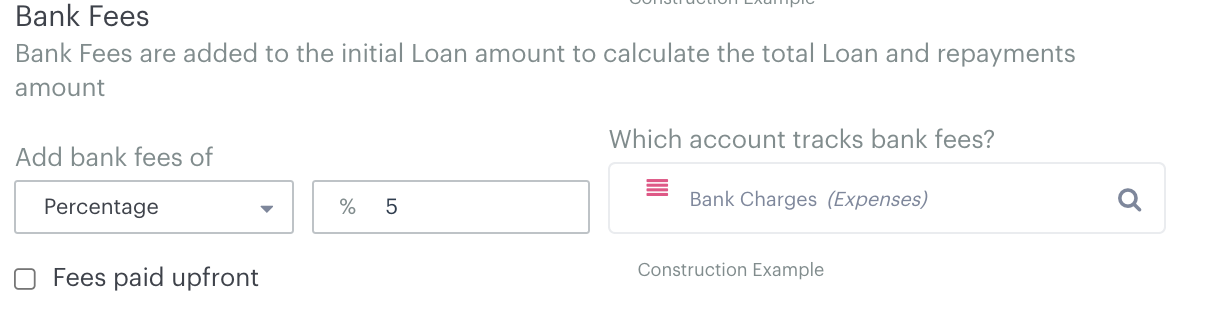

The wizard supports payment of fees as a percentage of the original loan amount or as a fixed value. Fees can be added to the loan or paid upfront. When you enter the bank fees you'll need to select an expense account which tracks those fees:

Fees are always charged to the expense account on the same date the loan is received. The default is for payment of the fees to be added to the loan amount, so in the sample of our 100,000 loan with 5% fees, we're actually taking a loan for 105,000.

The fees will be added to the loan liability, and repayments and interest will be adjusted accordingly for the additional 5,000 fee.

Alternately you can check 'Fees paid upfront', and they will be paid out of the bank account which credits the loan repayments.

- - - - - -

Managing loan overpayment

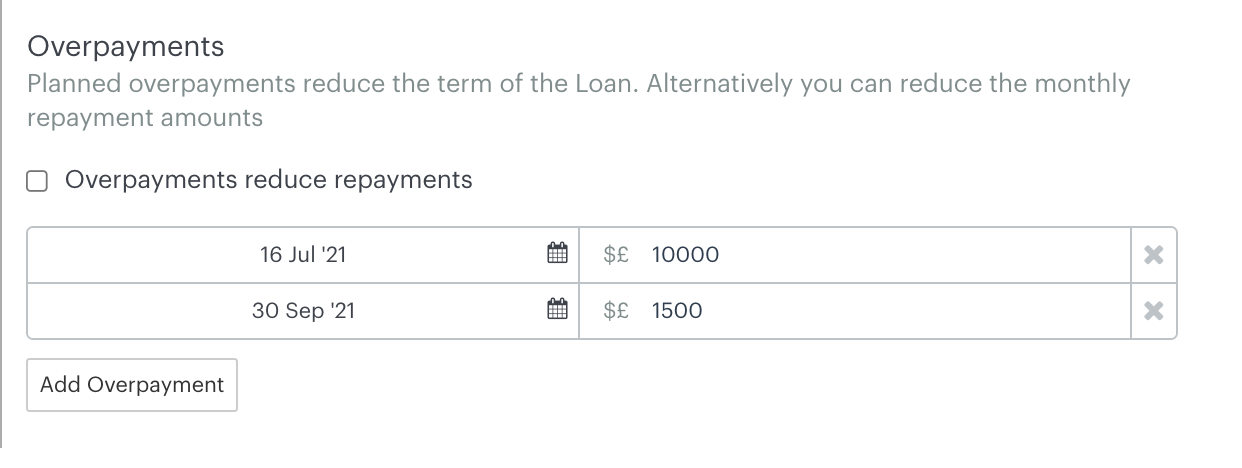

Overpayments allow you to forecast for one-off overpayments at any date during the loans lifetime. You can add new overpayments by pressing 'Add Overpayment' once for each overpayment required:

You can have an unlimited amount of overpayments over the life of the loan. By default overpayments will affect the term of the loan - so the total repayment each month will remain the same (the capital repayment is increased and interest payment decreased). If an overpayment is equal to or greater than the outstanding balance it will effectively repayment the loan immediately.

Alternately you can opt to reduce monthly repayments which will keep the loan term the same length. With overpayments reducing repayment the overpayment is removed proportionally from all future capital repayments.

As time passes and actuals are included in the forecast, calculations for the remaining repayments will assume any previously planned overpayments were paid. Un-required or cancelled overpayments can be removed by pressing the red 'X' next to the overpayment.