Learn how to connect a Xero organisation to Futrli Advisor for the first time, so that you can start creating reports, building forecasts and setting up alerts to manage your business on auto-pilot.

- - - - - -

Adding a Xero organisation

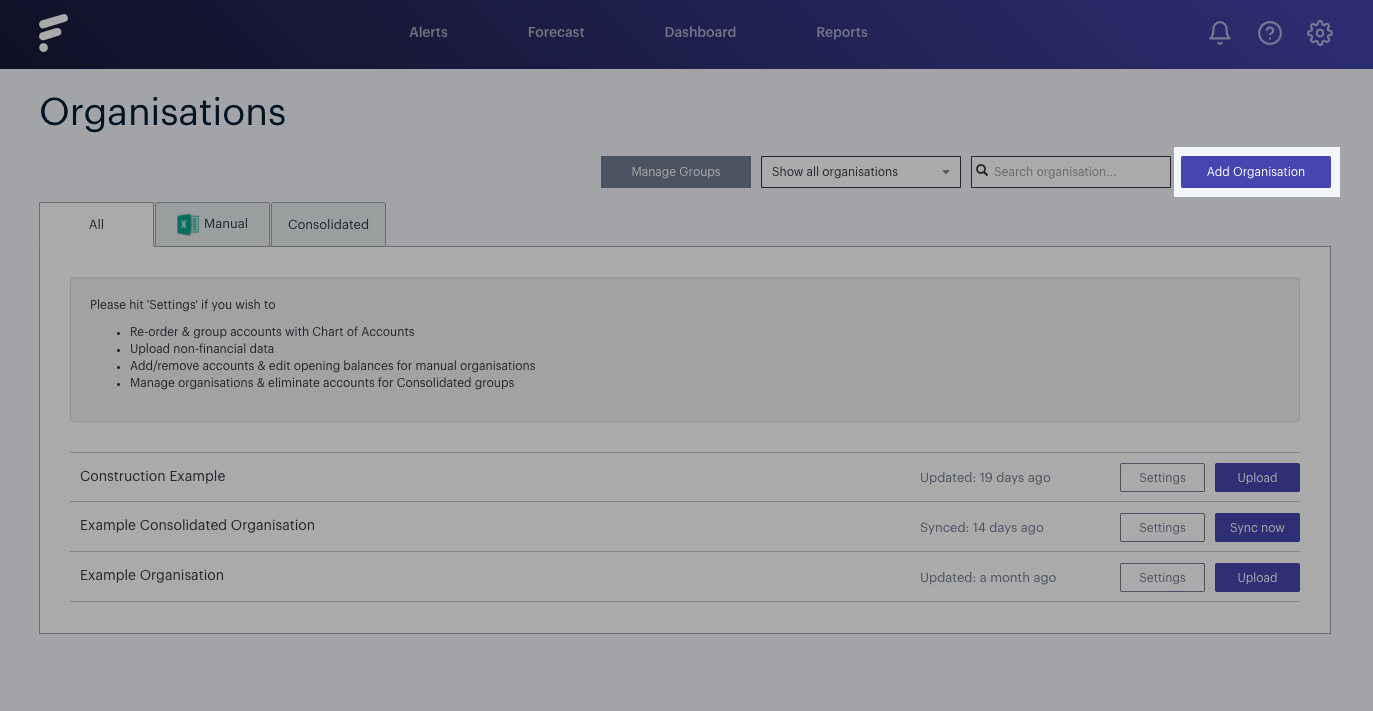

First, you need to navigate to the organisations section of Futrli Advisor. This is where you can add new organisations and view and manage existing ones which you’ve added or had access to.

Access to organisations can be found via the cog in the top right of the window. In the top right you’ll find the Add Organisation button:

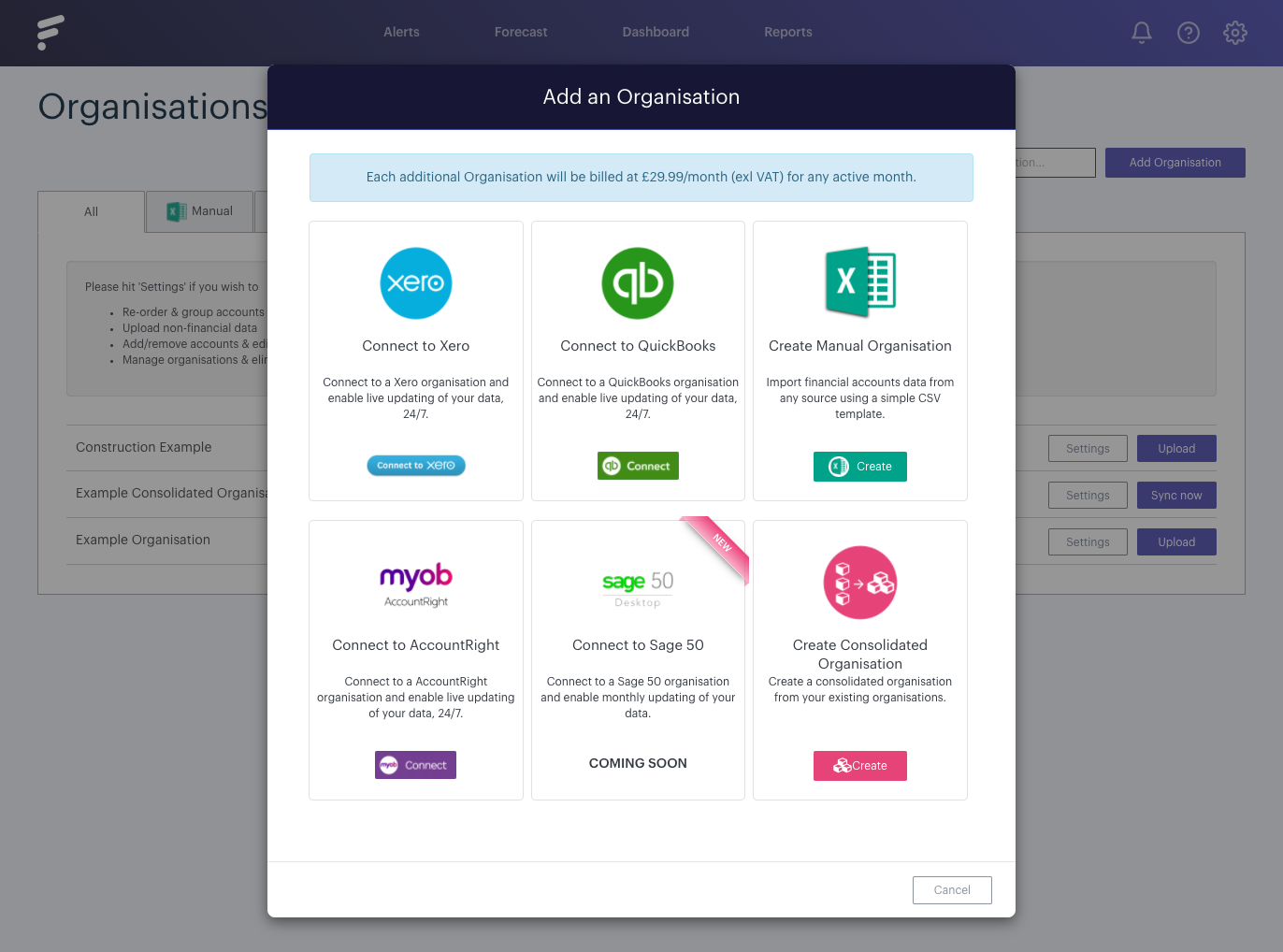

You will now see a box that offers you the various options for adding an organisation.

From the menu, you can choose which type of accounting package you have. In this example, we’re using Xero, but if you can just as easily get your data into Futrli Advisor using QuickBooks, MYOB or you can even import your data via CSV, so don’t worry.

If you have multiple organisations already synced with us and want to have a consolidated view of them, you can also do that here.

Select the option to connect to Xero button and you will be redirected to the Xero site where you will be asked to authenticate and authorise the connection to Futrli Advisor. This is a very quick and simple process and once complete, you’ll be taken back to Futrli automatically.

Once complete, you’ll be taken back to Futrli Advisor automatically. Here you will be asked to select the industry category for your organisation.

It will take a moment for your data to sync with Futrli Advisor. Don’t worry, we’ll let you know with a notification just as soon as the sync has completed.

Your data will also be set up to auto-sync daily, to ensure your insights are always up-to-date and correct.

Once you’ve connected your Xero organisation you can click on the settings button adjacent to your organisation, which will allow you to view and edit your organisation’s basic settings, chart of accounts and this is also where you can add any non-financial data.

You are now ready to start building boards, adding cards, creating forecasts and getting granular insights into your organisation’s finances. It really is that easy!