Before you can build a forecast for an organization in Futrli Advisor, you'll first need to enter the organization's settings. These allow Futrli Advisor to automatically calculate your GST/VAT obligations and map your 'Accounts Receivable', 'Accounts Payable' and 'Bank Account' movements.

- - - - - -

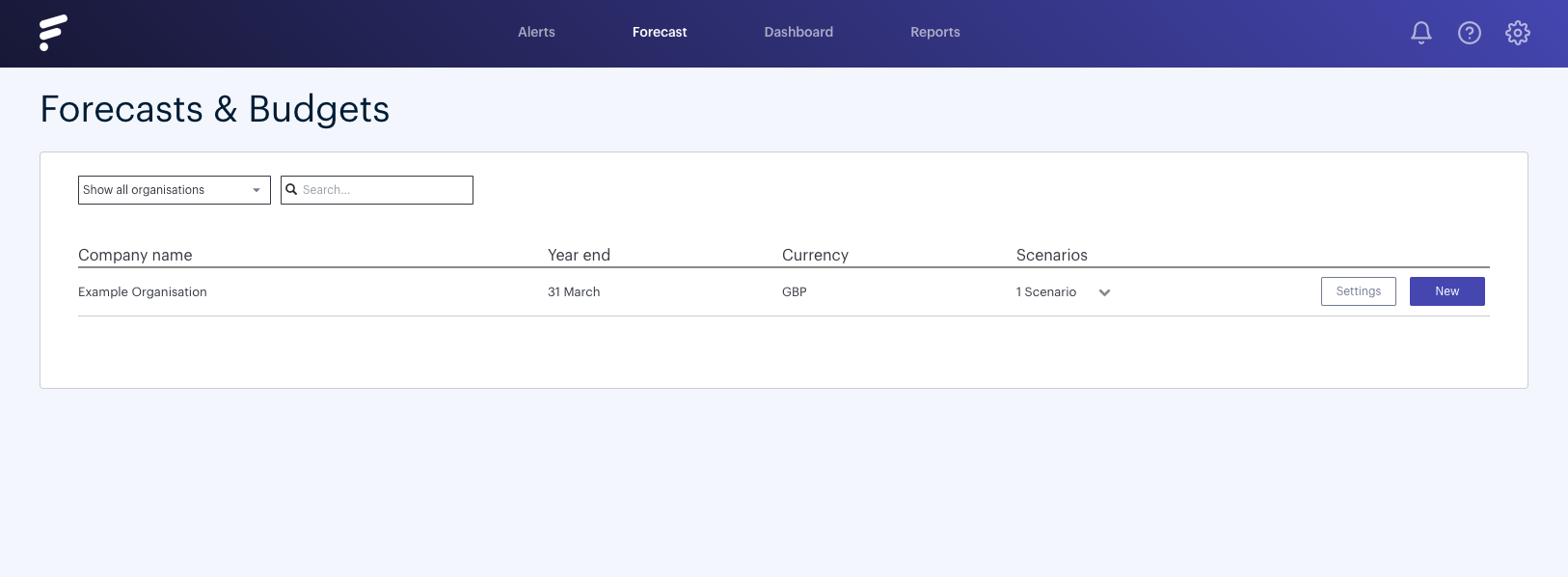

Step One

Navigate to the 'Forecasting' section of Futrli Advisor. Here you'll find each of the organizations which you have access to listed, as well as any forecasts which have been created for them. This is also where you can create new forecasts. Before you can create a forecast for an organization for the first time, you'll need to complete the organization settings. To do so click the 'Settings' button adjacent to the organization:

- - - - - -

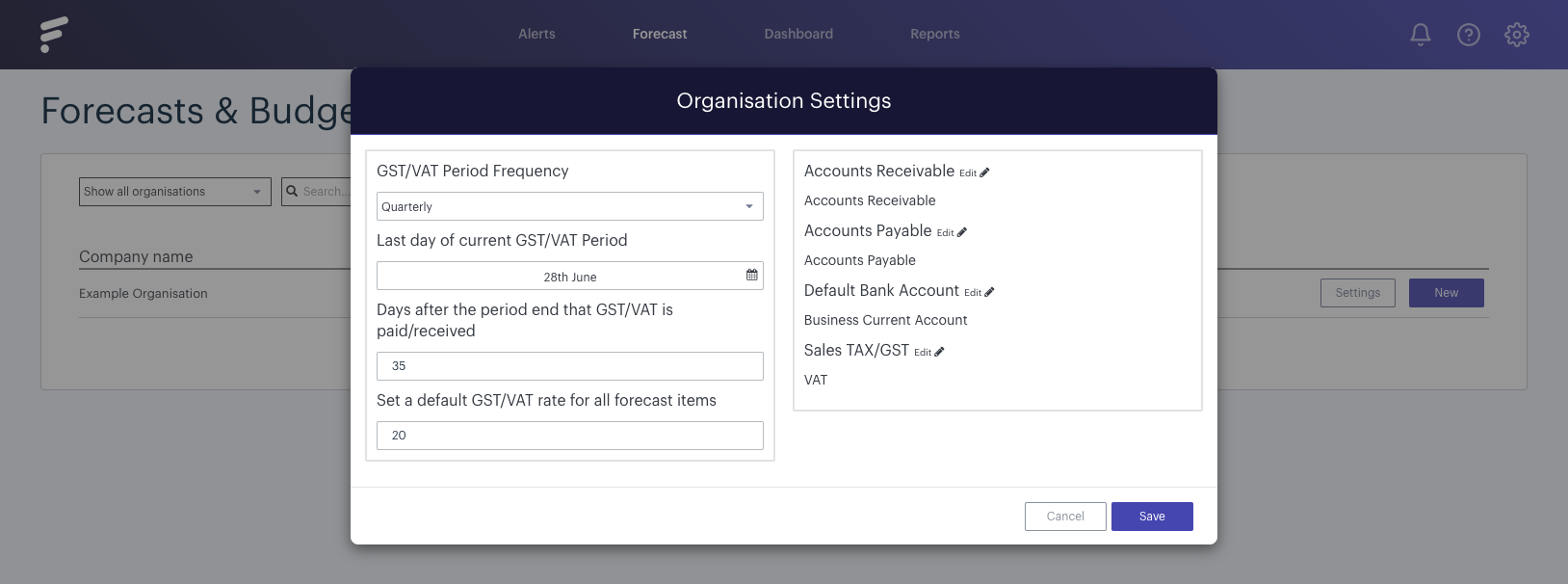

Step Two

Clicking into 'Settings' will open a window where the organization's settings can be set and updated.

First up, set the GST/VAT defaults. If you leave this as 'Do not pay tax', no forecast item within the forecast will have an option to have GST/VAT added. If you do pay tax, just set the period frequency, the last day of the period, the number of days the GST/VAT is paid/received and the default rate for forecast items (the default rate isn't a mandatory field, it's designed to save you time when forecasting by pre-populating the VAT rate field for you within forecast items).

Next, we need to set the default accounts for your 'Accounts Receivable', 'Accounts Payable', 'Default Bank Account' and 'Sales Tax/GST':

These defaults can be overridden within individual forecast items. Just look out for the option 'Override Journal Defaults', you can adjust as you please!

When happy with your organization's default settings, just hit 'Save' and you'll be ready to create your first forecast!