Forecasts in Futrli Advisor are how you are going to look into the future, forecast items are the key to that! Every account within the organization's chart of accounts can have an unlimited number of forecast items created against it, all you need to decide is the method you'd like to use!

- - - - - -

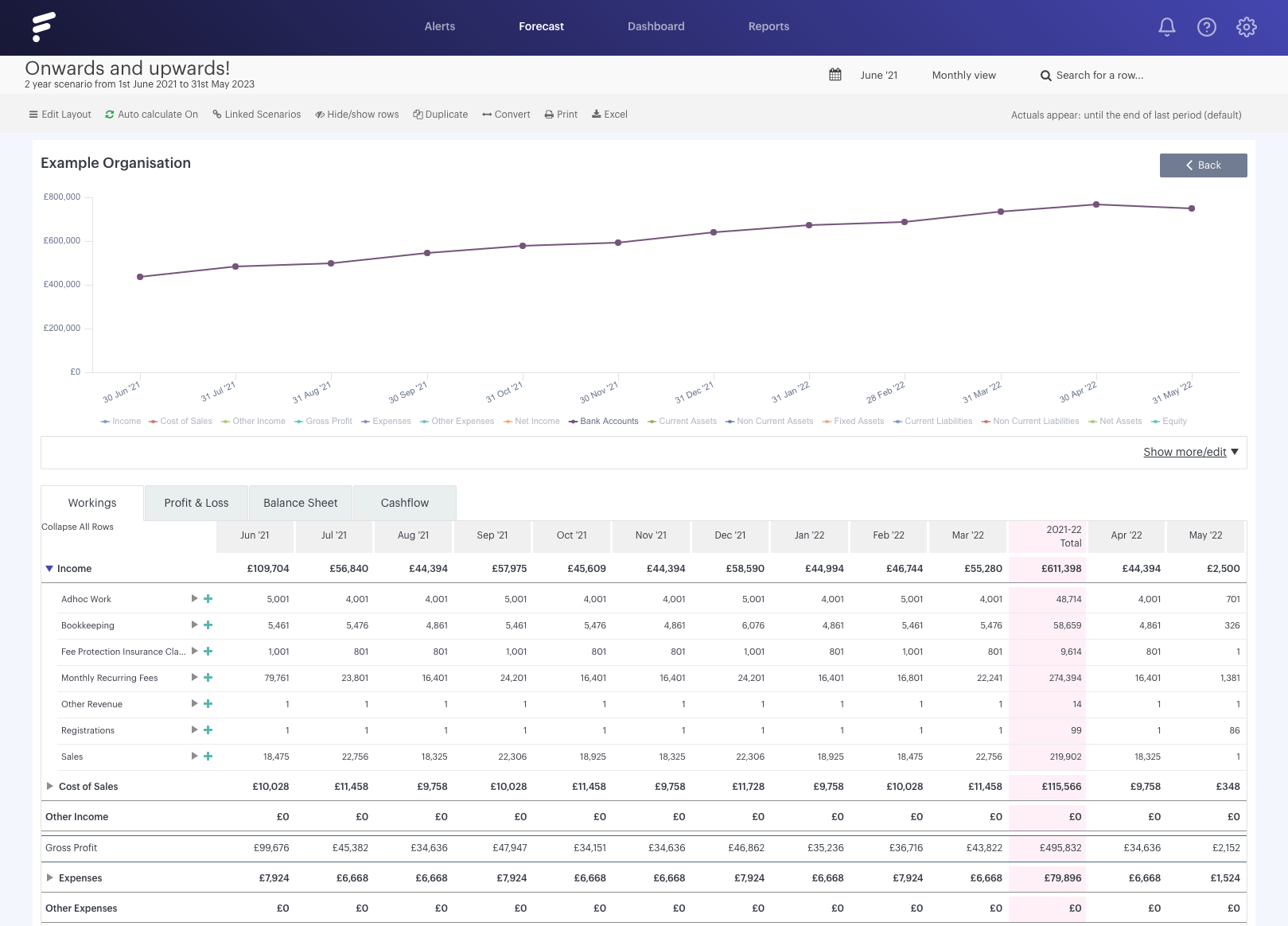

When it comes to creating a forecast item, you'll need to ensure you are in the 'Workings' tab of the Forecast. Expand the account category to expose accounts by clicking the title of the account category, you'll then see a green cross. This is what you'll need to click to create a forecast item:

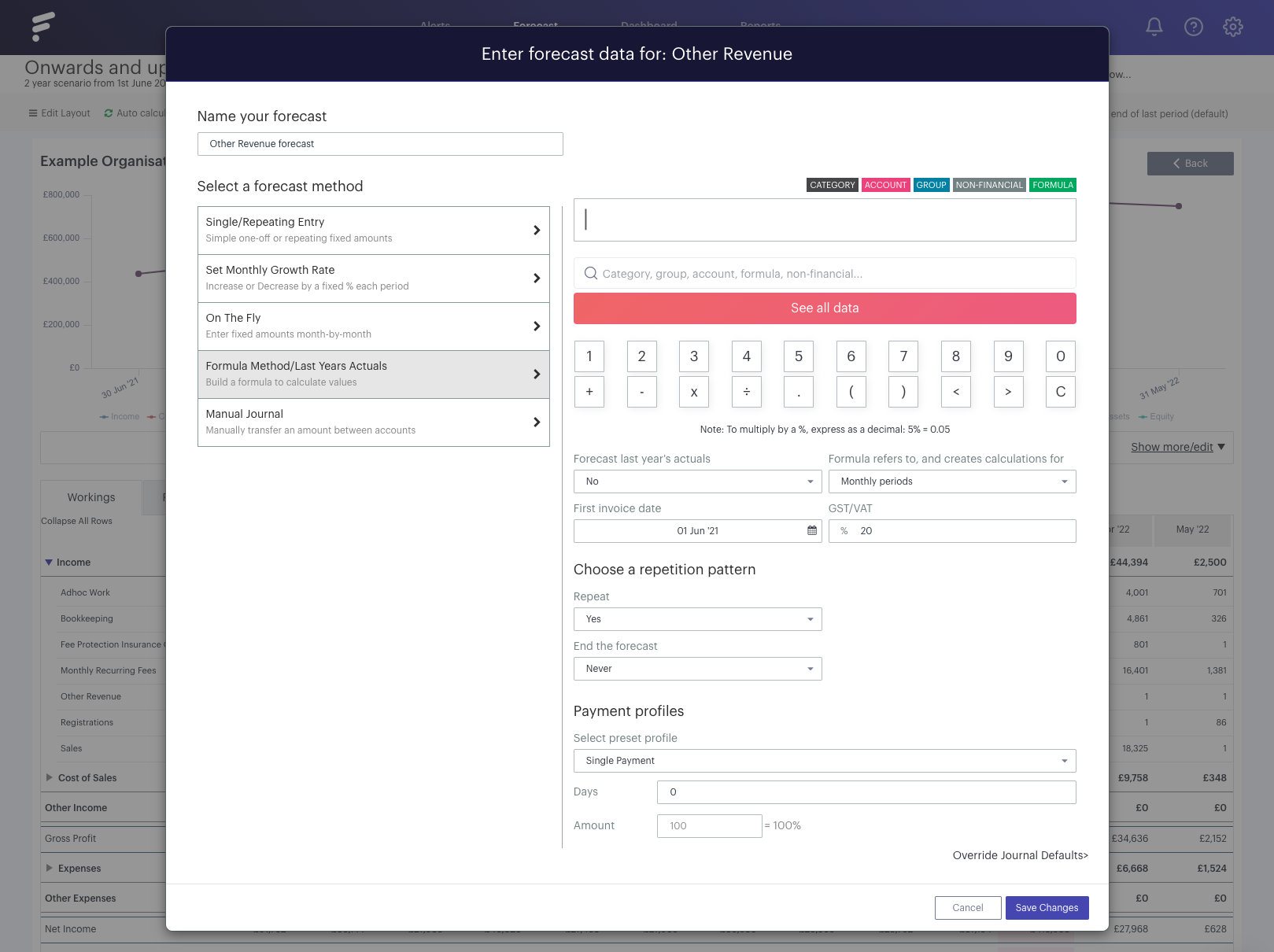

Clicking this green cross will open out your forecast item, which is where we can start exploring your forecasting options. You can see the five methods available, so let's run through them!

- - - - - -

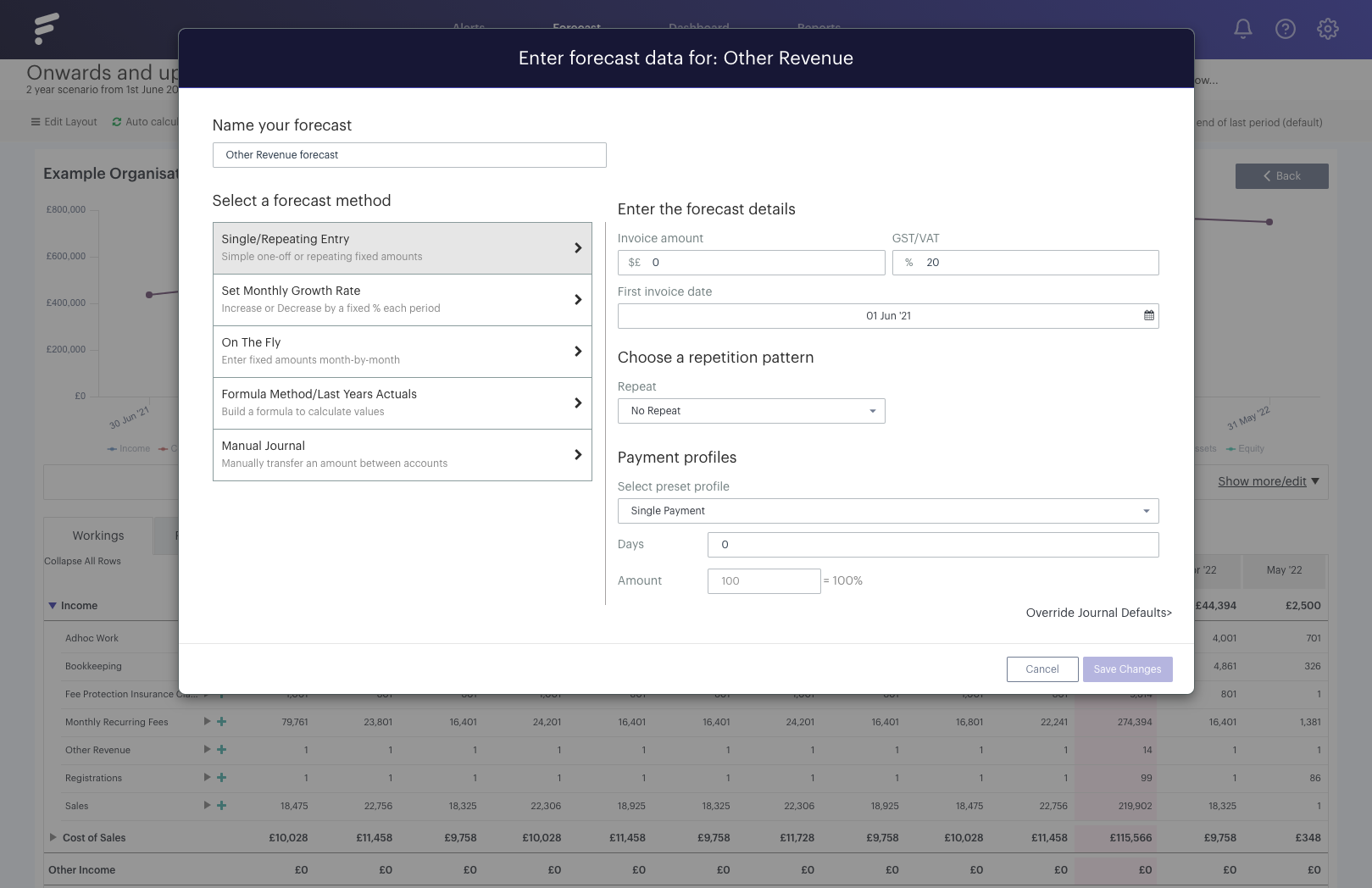

'Single/Repeating Entry'

The number you add here will be consistent according to the repetition method you go with. Enter your invoice amount, set the GST/VAT rate, then select the first invoice date.

Is this going to be a one off entry, or a repeating entry? You have various repeating options, from daily to annually. You can then set how often, so would you like this repeating every one week? Every five years? You can also set when you would like the repetition to finish.

Finally, you can adjust the forecast item's payment terms (this help guide gives you more information on there terms):

- - - - - -

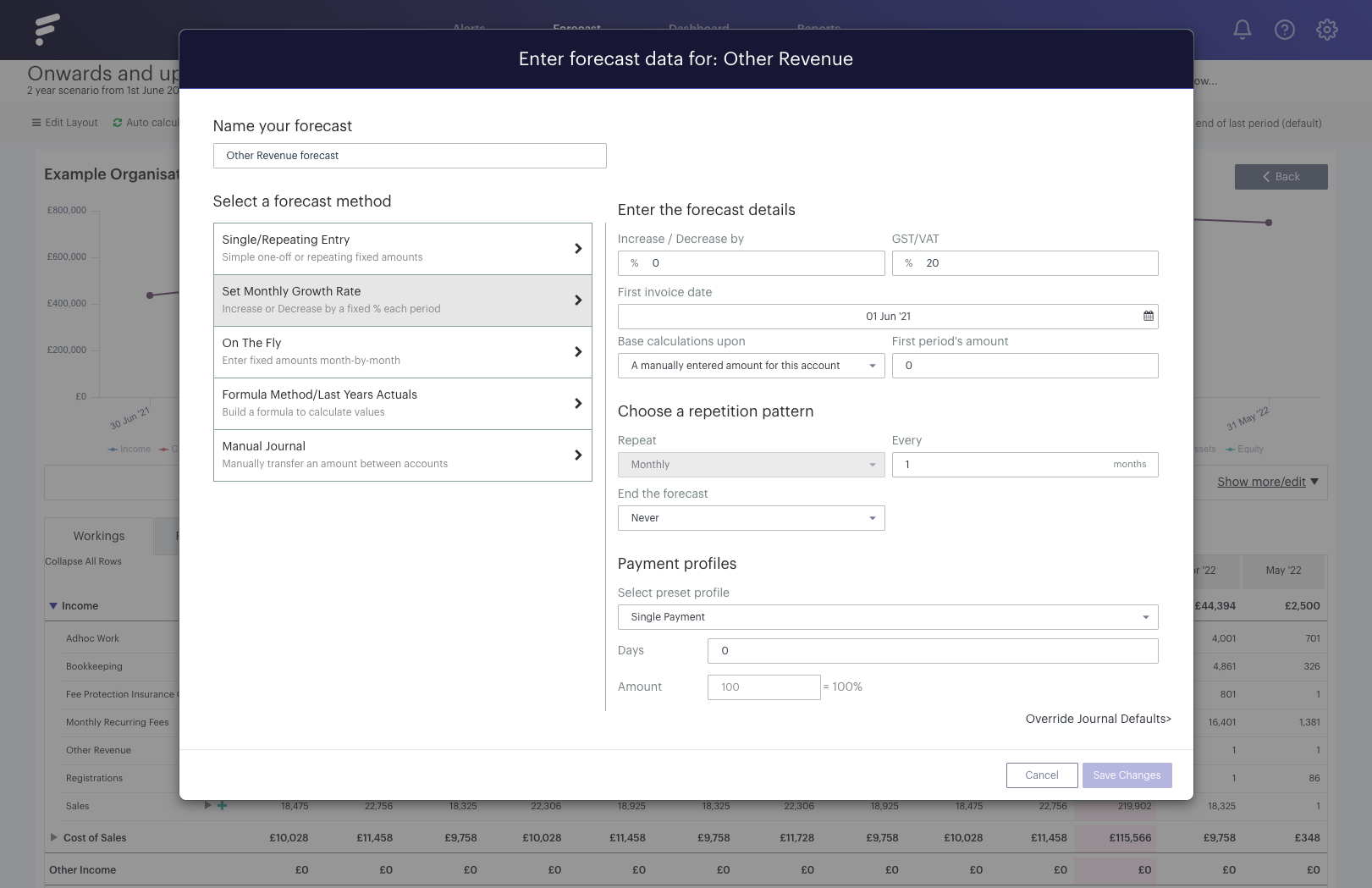

'Set Monthly Growth Rate'

Whilst the 'Single/Repeating Entry' allows you to repeat a single figure, this method gives you the option to add an increase or decrease. Not only this, you can use an average of the last three, six or 12 months, again with an increase or decrease if you'd like!

Set your increase or decrease percentage (you won't be able to leave this as zero) and set the GST/VAT rate. The first invoice date will then need to be set, before you can decide to use a manually entered starting figure, or an average of the previous number of months.

This has to be a monthly repetition pattern, but you can set it to repeat every certain number of months as well as setting when the repetition concludes.

Finish up by setting your payment terms and you're good to go:

- - - - - -

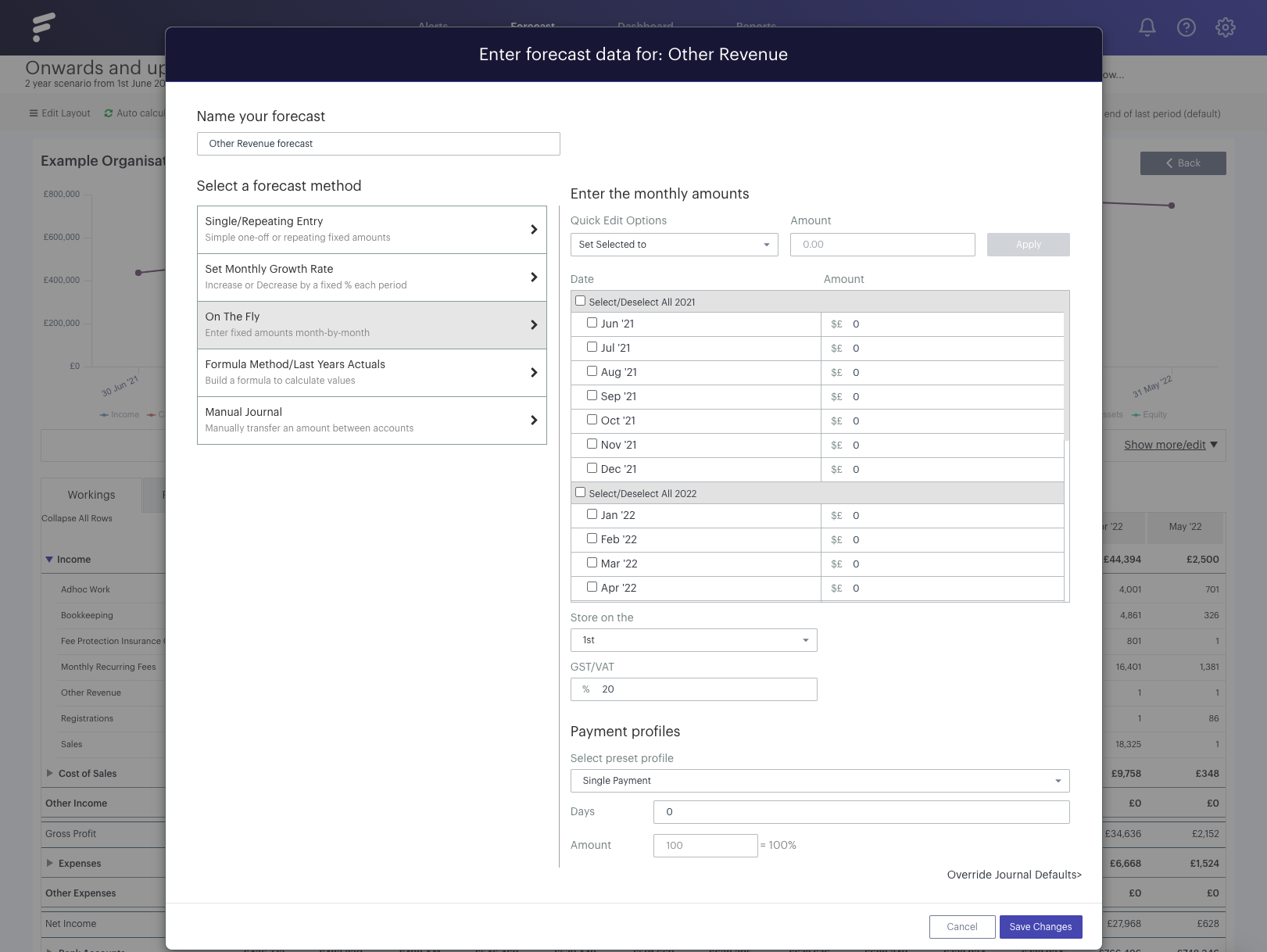

'On The Fly'

This is much more static method. Each month within the forecast's date range will be available to have a figure entered against it. If you create a forecast via CSV, each row within the CSV will be added as an 'On The Fly' forecast item.

The 'Quick Edit Options' will be your best friend when using 'On The Fly'. Using this, you can:

- Set selected to

- Increase selected by %

- Decrease selected by %

- Add £$ to selected

- Subtract £$ from selected

- Split between selected

You'll just need to then select which date in the month the movement occurs, set the GST/VAT rate and ensure the payment terms are as you need:

- - - - - -

'Formula Method/Last Years Actuals'

This is how you can get creative with your numbers! Futrli Advisor's formula builder allows you to reference different accounts, account categories, other pre-made formulas and even look at data from previous periods!

If you wanted to reference last year's actuals, just ensure the drop down is set to 'yes'. You'll then see the formula auto-complete with the account in question, but with a period offset of 12 months set against it.

Set the formula up as you wish, ensure that the periods being referred to, first invoice date and GST/VAT settings are all showing as expected, then choose your repetition pattern and payment terms. You can always tweak the formula if it is not showing quite as expected!

- - - - - -

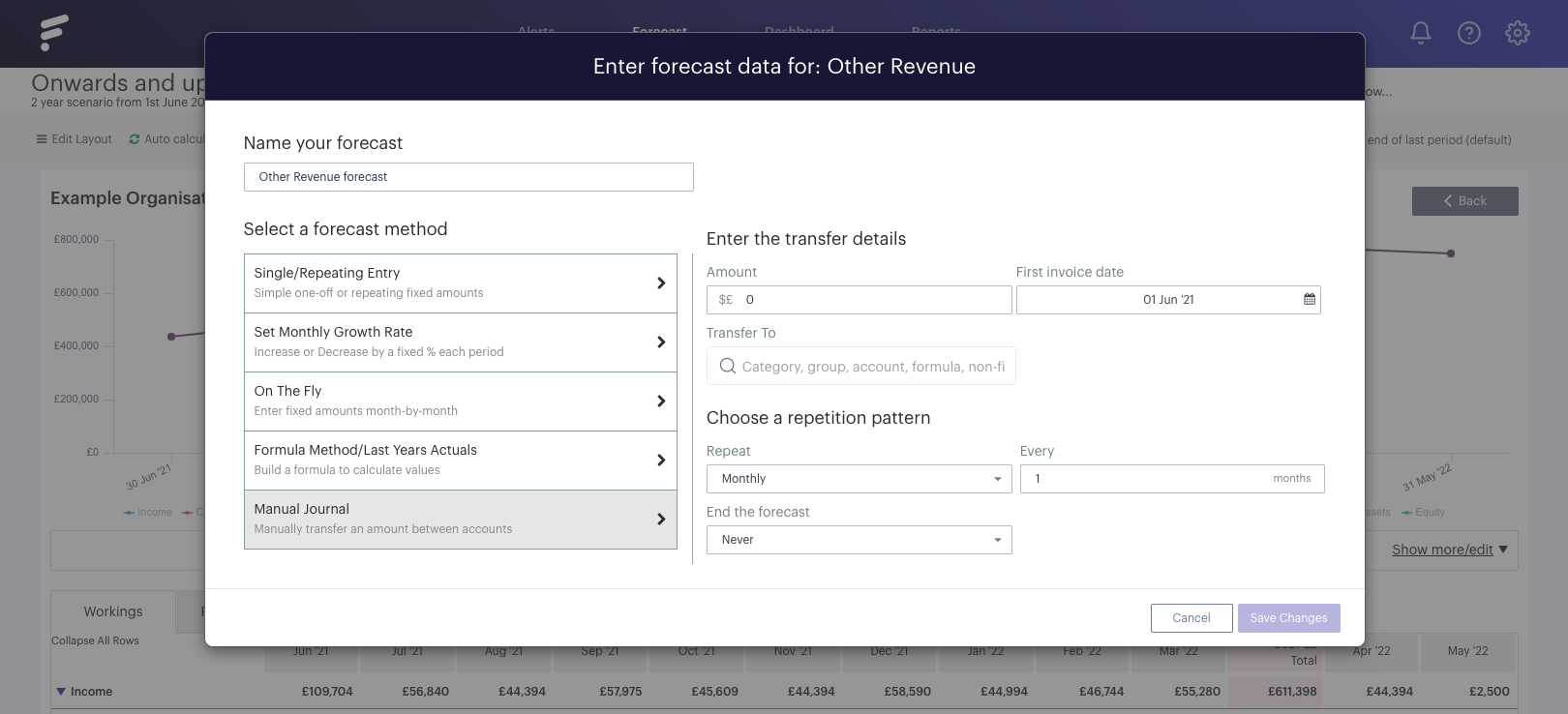

'Manual Journal'

Slightly different to the other four options, this is the tool used to move figures from one account to another.

Set the amount along with the GST/VAT and the first invoice date, choose the repetition pattern and select the payment terms:

- - - - - -

With each of the methods available, you'll notice a 'Override Journal Defaults' option. We won't look into this here, but you can explore this further, if you'd like!