What does this guide cover?

In response to the COVID-19 outbreak, the UK government has introduced a temporary change that VAT payments due between March 20th 2020 and June 30th 2020 can be deferred to a later date.

In this guide, we will walk through how you can update your Futrli Advisor forecast to include this change.

VAT payments are calculated automatically within Futrli Advisor based on the forecast that you have created. As this is an unprecedented situation, there isn't an option to defer a quarterly payment. However, there is a simple method to use that will update your forecasted Cashflow.

- - - - - -

How do I defer a VAT payment?

In this example, we are going to use an organisation that pays VAT quarterly and take a VAT payment due on March 31st, setting it to be added to our June 30th VAT payment. We can do this with two Forecast Items added against our VAT account.

In Futrli Advisor, VAT payments are shown as a receivable figure and as a payable figure. The difference between these two figures gives us our VAT payment due.

Step 1 - calculate the net VAT payment

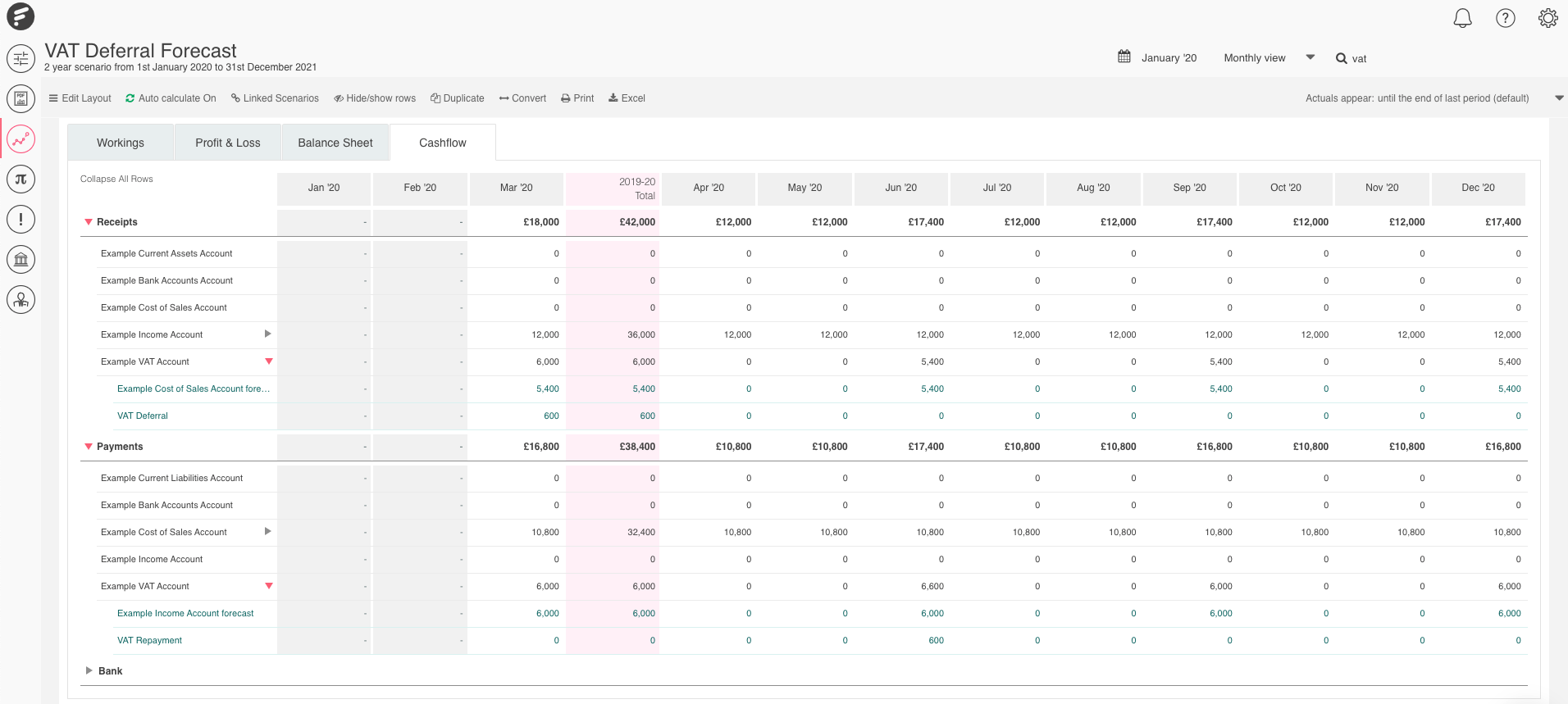

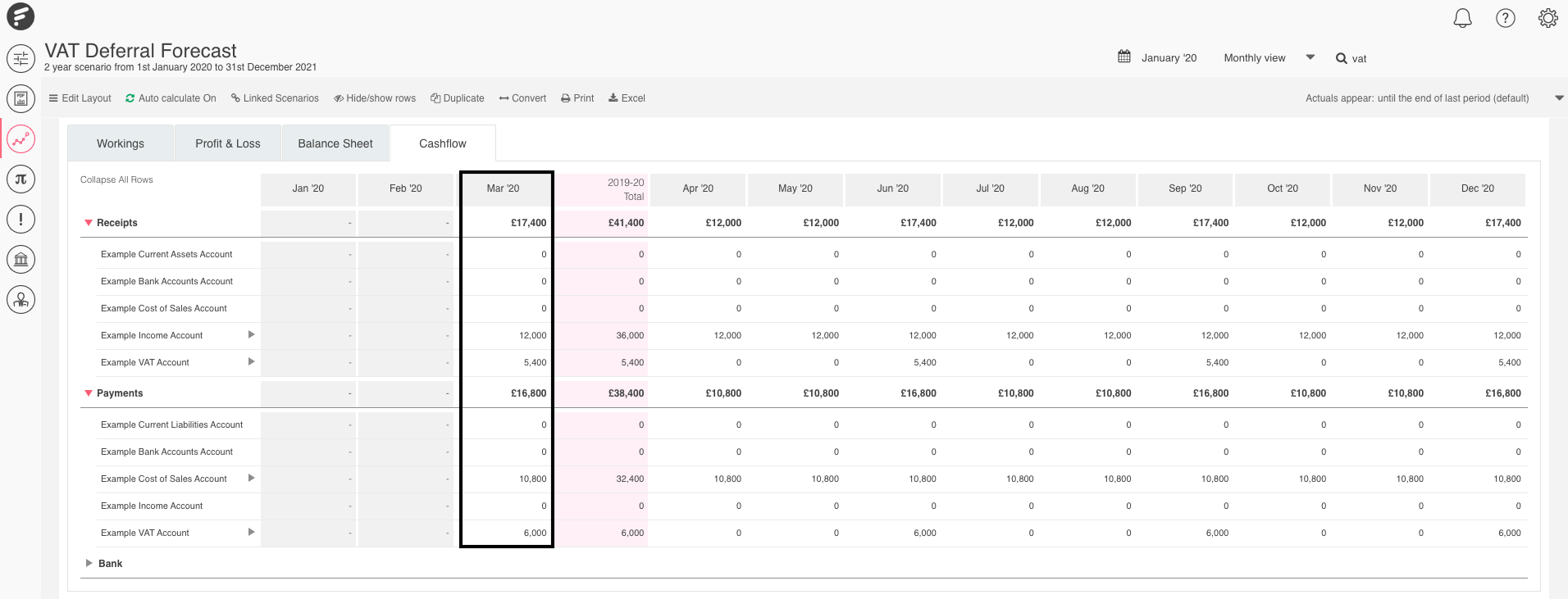

In our Forecast, we can jump into the Cashflow tab. Here we can see that in the month of March 2020 we have a VAT receivable total of £5,400, whilst the VAT payable is £6,000. This will result in a net VAT payment due of £600. These figures are a cumulative total for the last quarter, as per our VAT settings:

What we want to do is move that payment of £600 to the June VAT payment, which we can do with two simple Forecast Items!

Step 2 - create Forecast Items

To update our Cashflow, we need to create two Forecast Items against our VAT liability account. The first will take the £600 back into the bank rather than being paid off, the second will increase our June VAT payment by the £600.

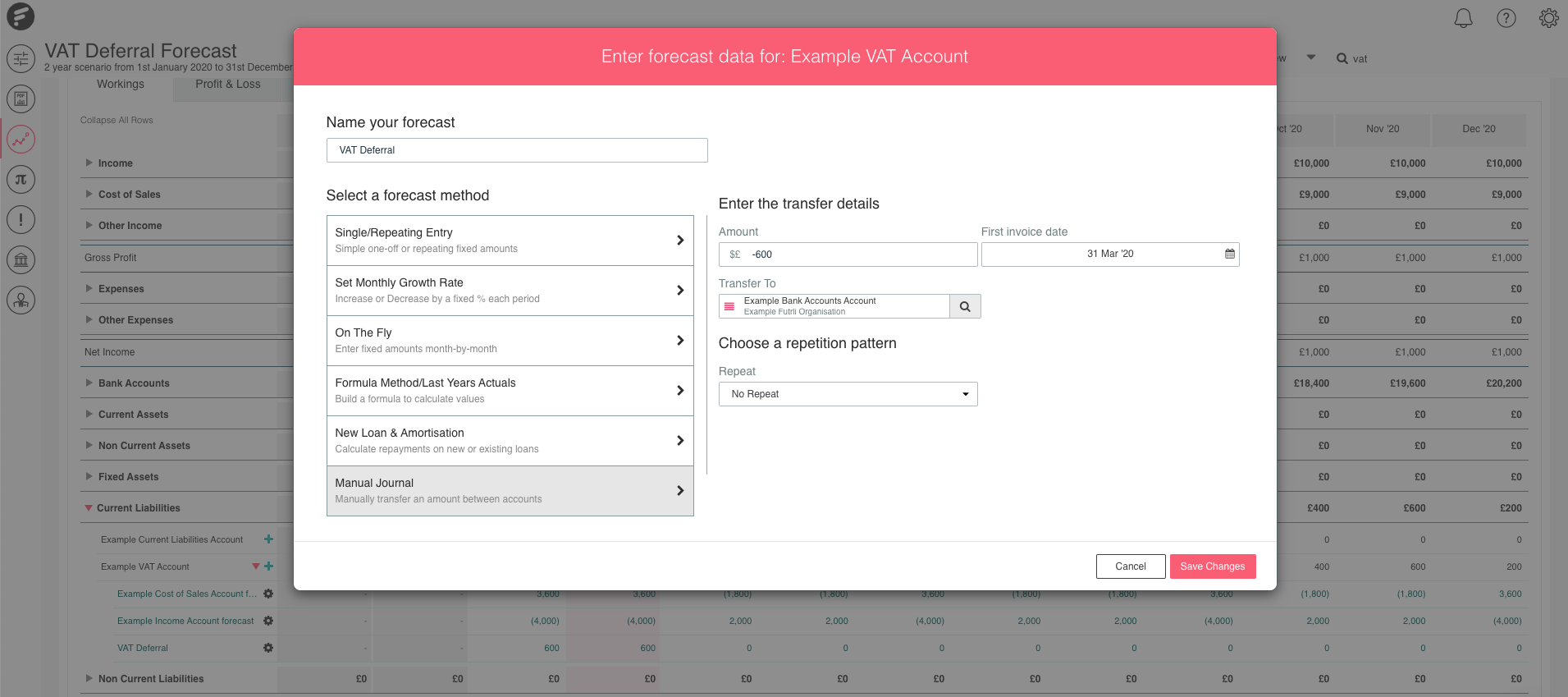

Start off by locating your VAT liability account. You'll need to click the green plus symbol to add a new Forecast Item. We need to debit our bank and credit our liability, so knowing that it is £600, we can use the Manual Journal method of forecasting. Enter -600, therefore removing the £600 from our VAT liability account and select the bank account to be debited.

Make sure the date is set accordingly to when the VAT payment is due, then hit Save Changes:

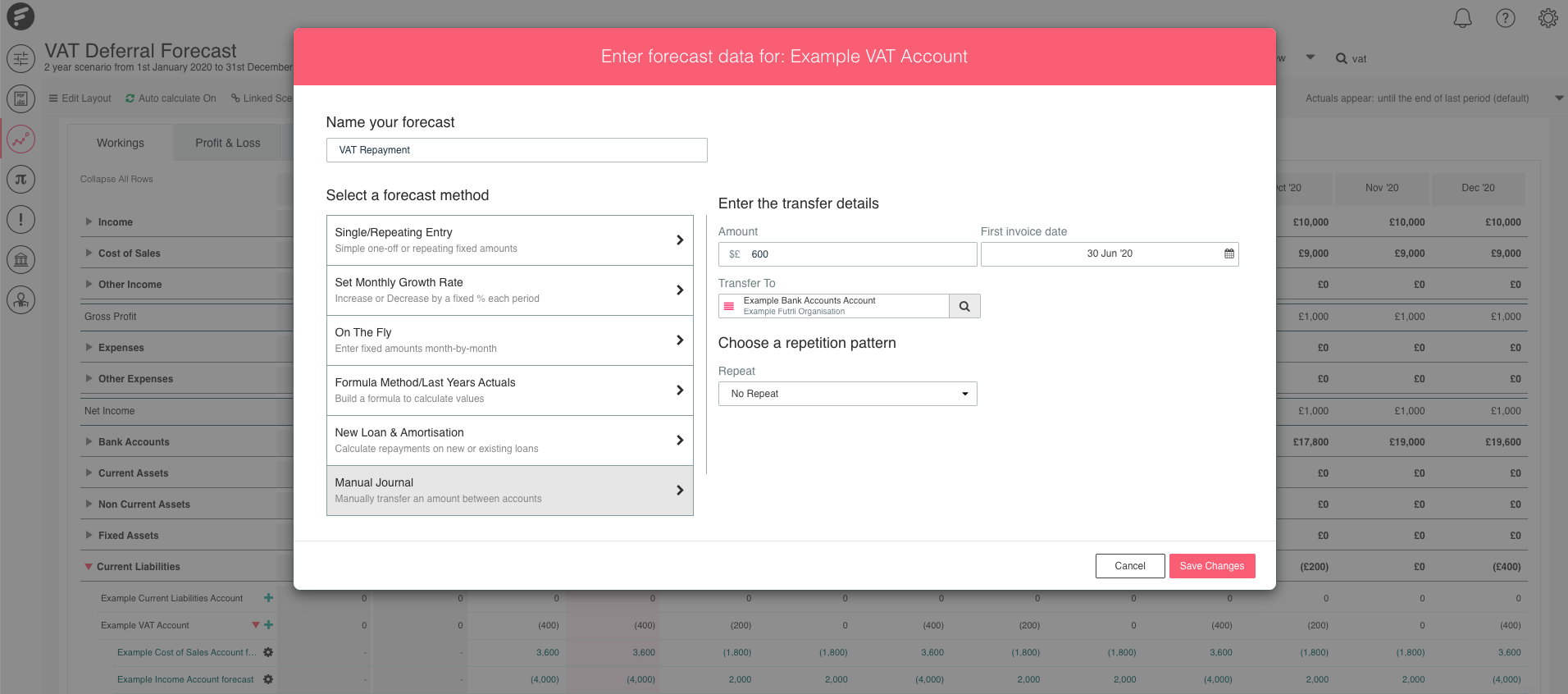

The second Forecast Item we create will be the inclusion of the deferred payment in June's payment. So put simply, we need the VAT payment in June to increase by £600.

Again, we'll use the Manual Journal forecasting method, except this time we will be transferring £600 from our bank account into our VAT liability.

We will still be creating this Forecast Item against our VAT liability, only this time the total will be £600, making sure we set the date accordingly to the next VAT payment. The result will be £600 being drawn from the bank and increasing the VAT liability account:

The result

With these two Forecast Items set up, we will now be able to see that the totals for March and June's VAT receivable and payable have updated.

In March, both now sit at £6,000, rather than £5,400 and £6,000 and we previously had.

In June, The receivable total remains at £5,400, but our payable total has increased to £6,600, resulting in a total payable amount of £1,200: