Calculating 'Income Tax' in your Futrli Advisor forecast is nice and easy! In this guide, we'll run through the two forecast items you need to create.

- - - - - -

In this example, we will be calculating our income tax liability and paying this liability every financial quarter for our income tax obligations.

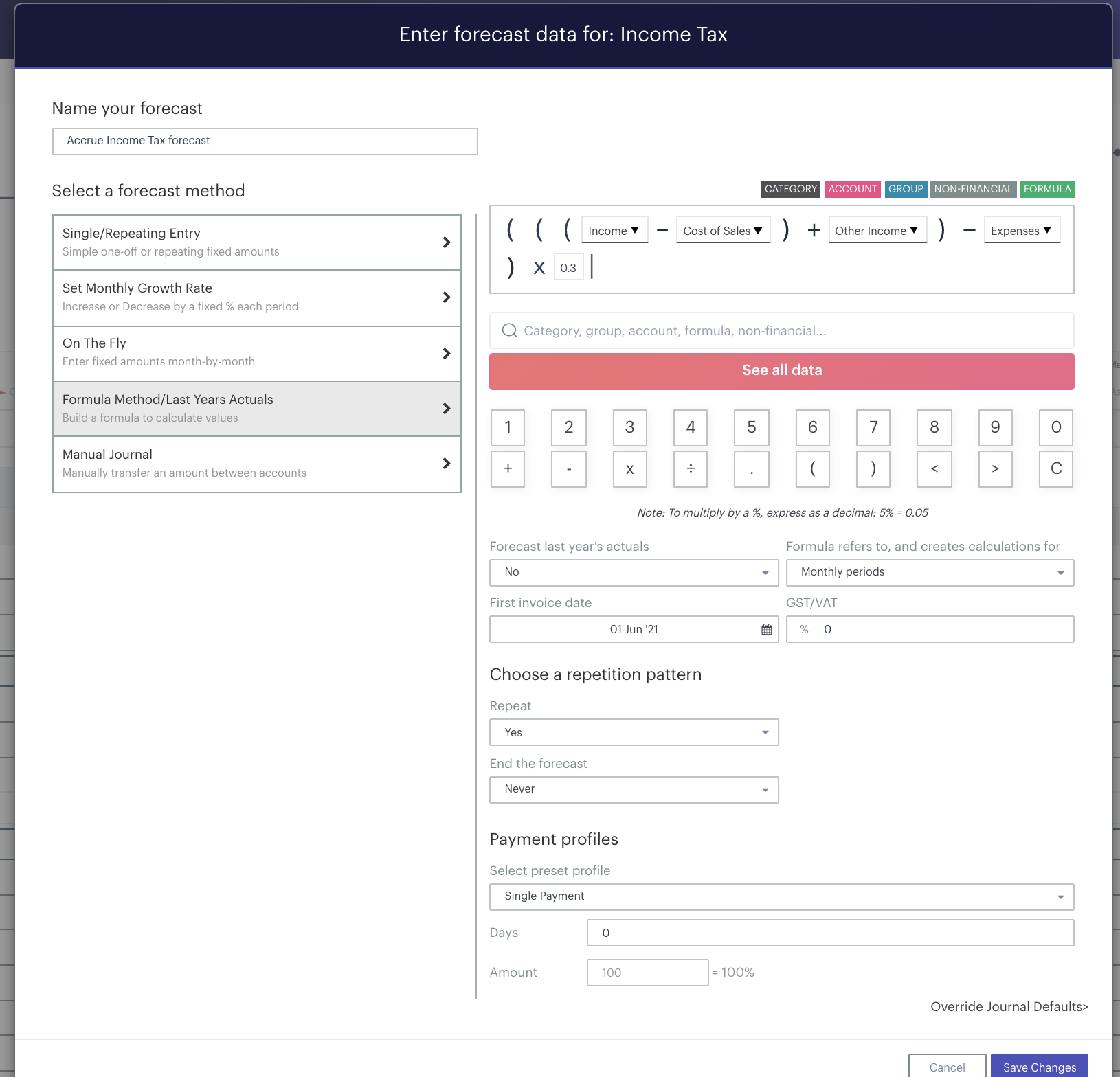

First, we will calculate our income tax using our Income Tax account, which will be located in the 'Other Expenses' account category:

This will be a new forecast item against this account. It will be referring to monthly periods and will use the formula method of forecasting. We will also be treating this forecast item as a 'No Cash', as we are only accruing our income tax liability at this stage.

In this example, the company tax rate is 30%, so we will be multiplying our net income by 30% (this will vary depending on your income tax obligations) in order to calculate how much income tax we will owe:

Note: We exclude our 'Other Expenses' account category from this calculation in order to avoid a circular reference error, but any accounts that need to be part of this calculation under this account category can be added separately within the formula.

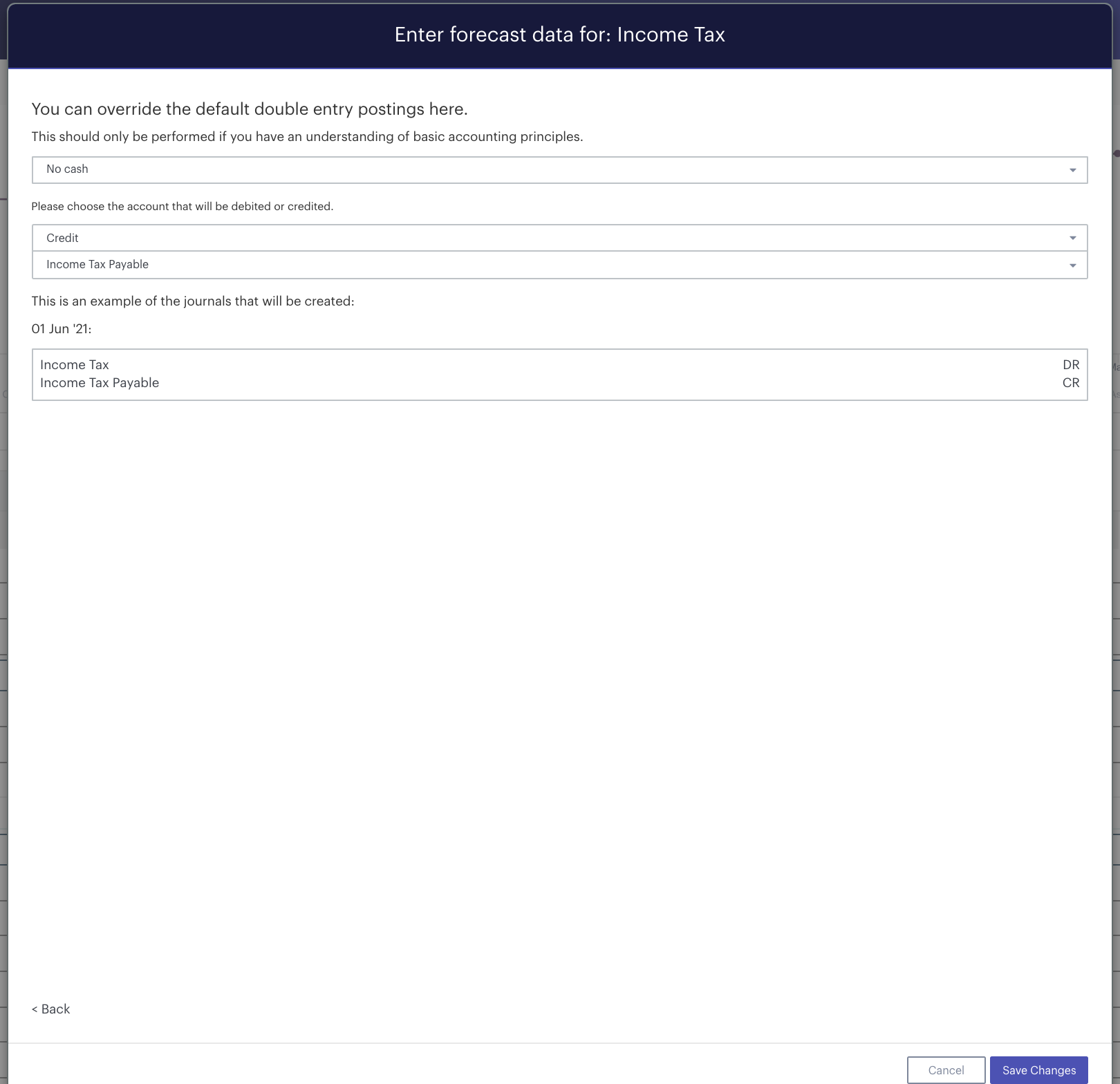

We'll be using the 'Override Journal Defaults' option to manually override the credit and debit movements for the forecast item, as well as setting this as 'No cash':

When that has been set up, hit 'Save Changes' and the forecast item will save into the forecast.

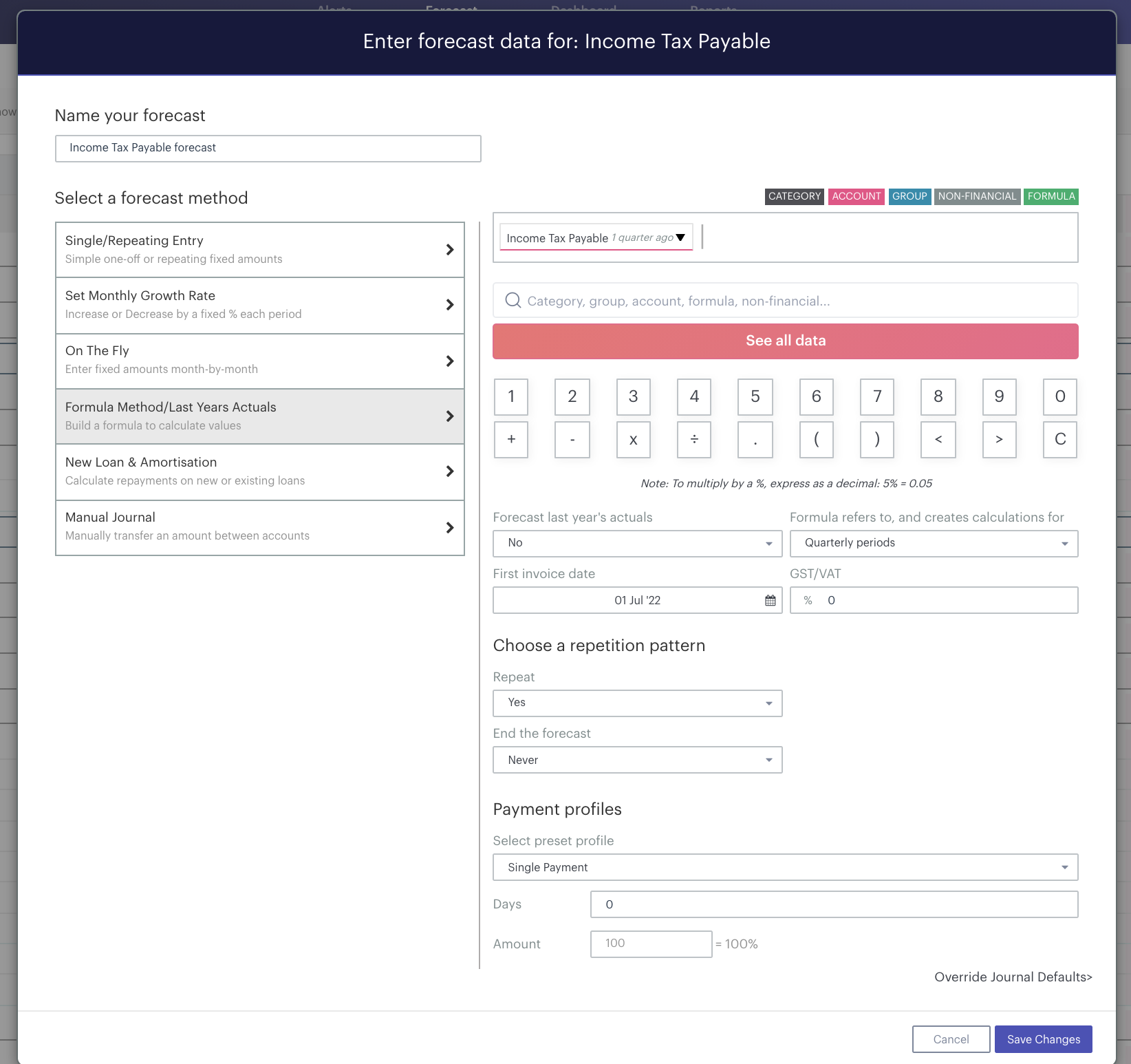

Next up, we'll need to create a new forecast item in the balance sheet section against the tax liability to record the payment on a quarterly basis.

Once again we will use the formula method, but this time we will be referencing the tax liability account with a period offset option of one period and refer to quarterly periods:

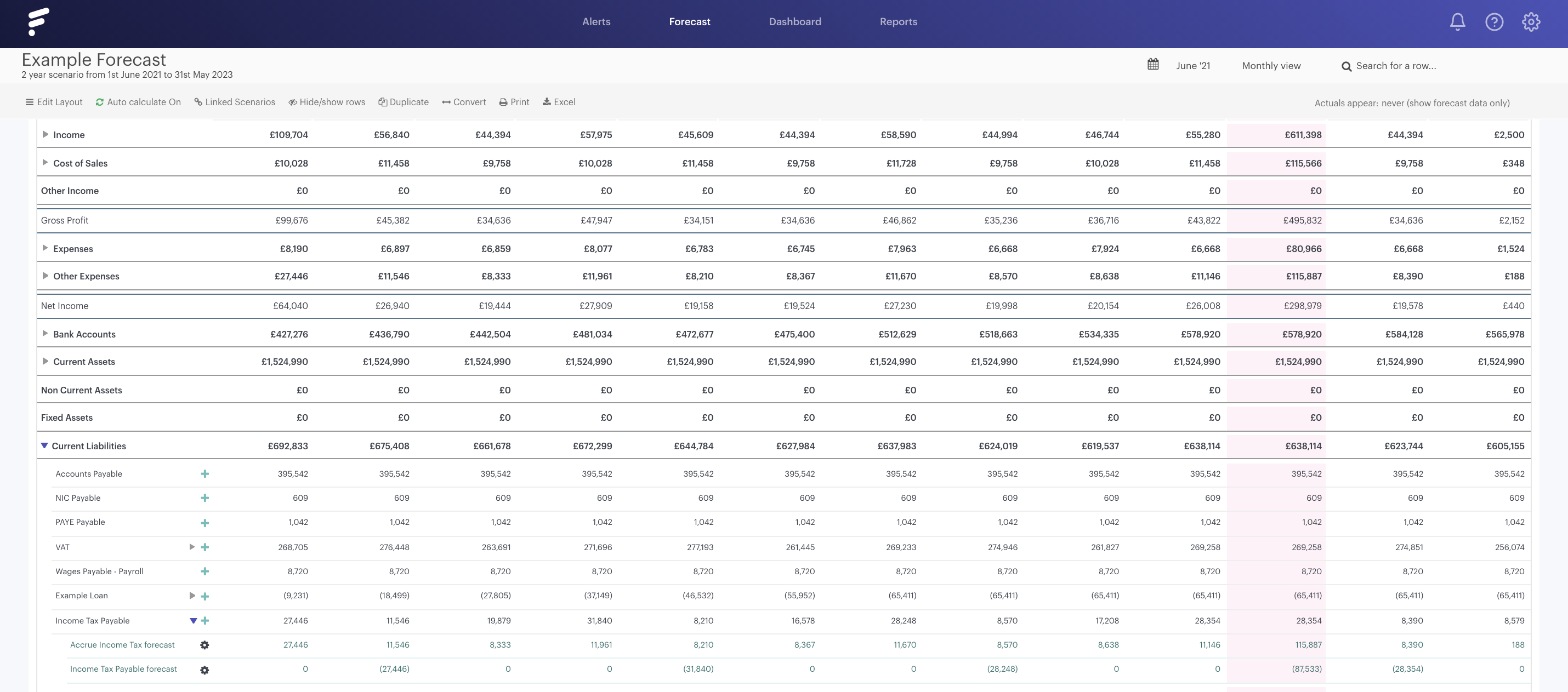

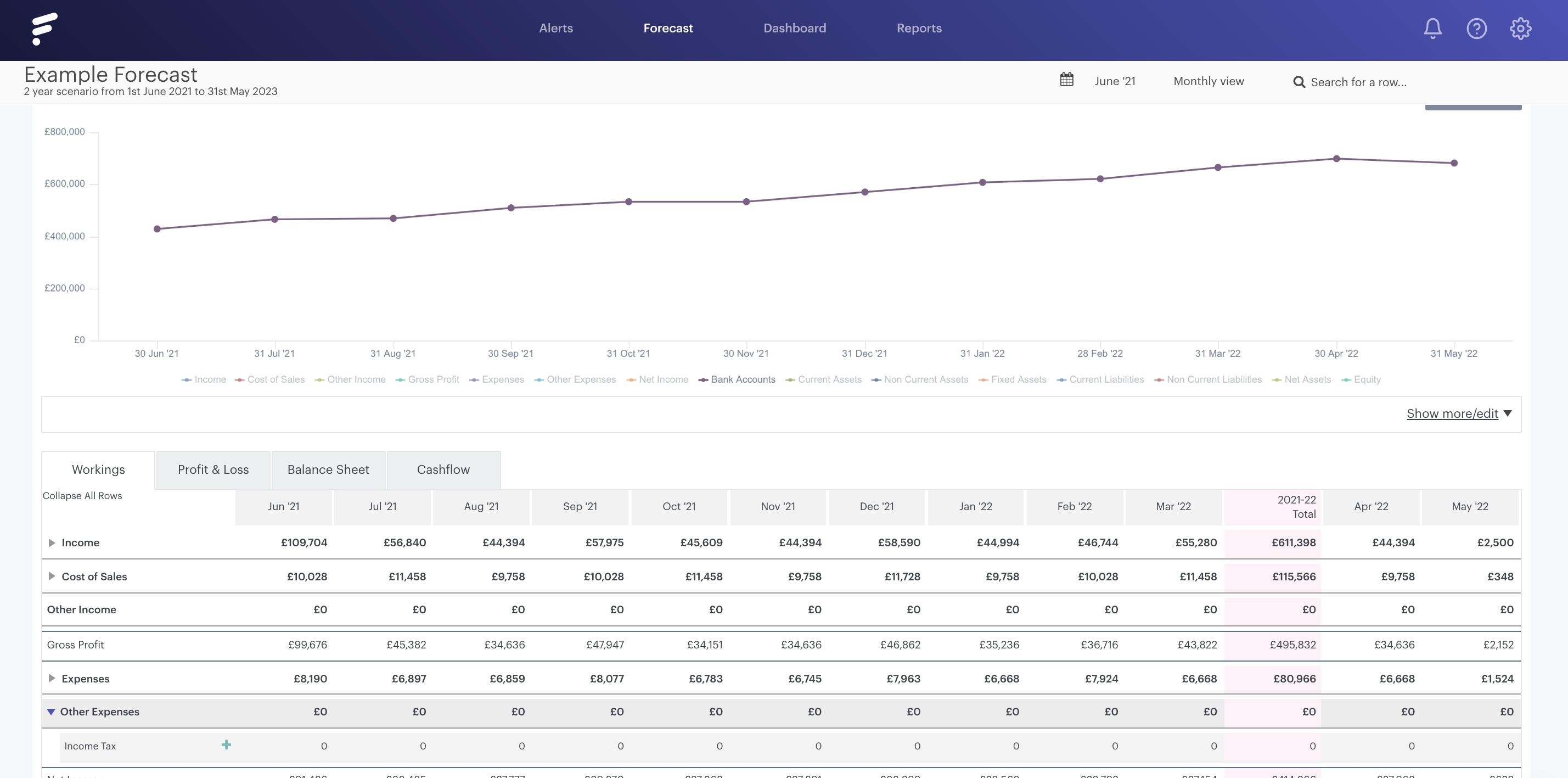

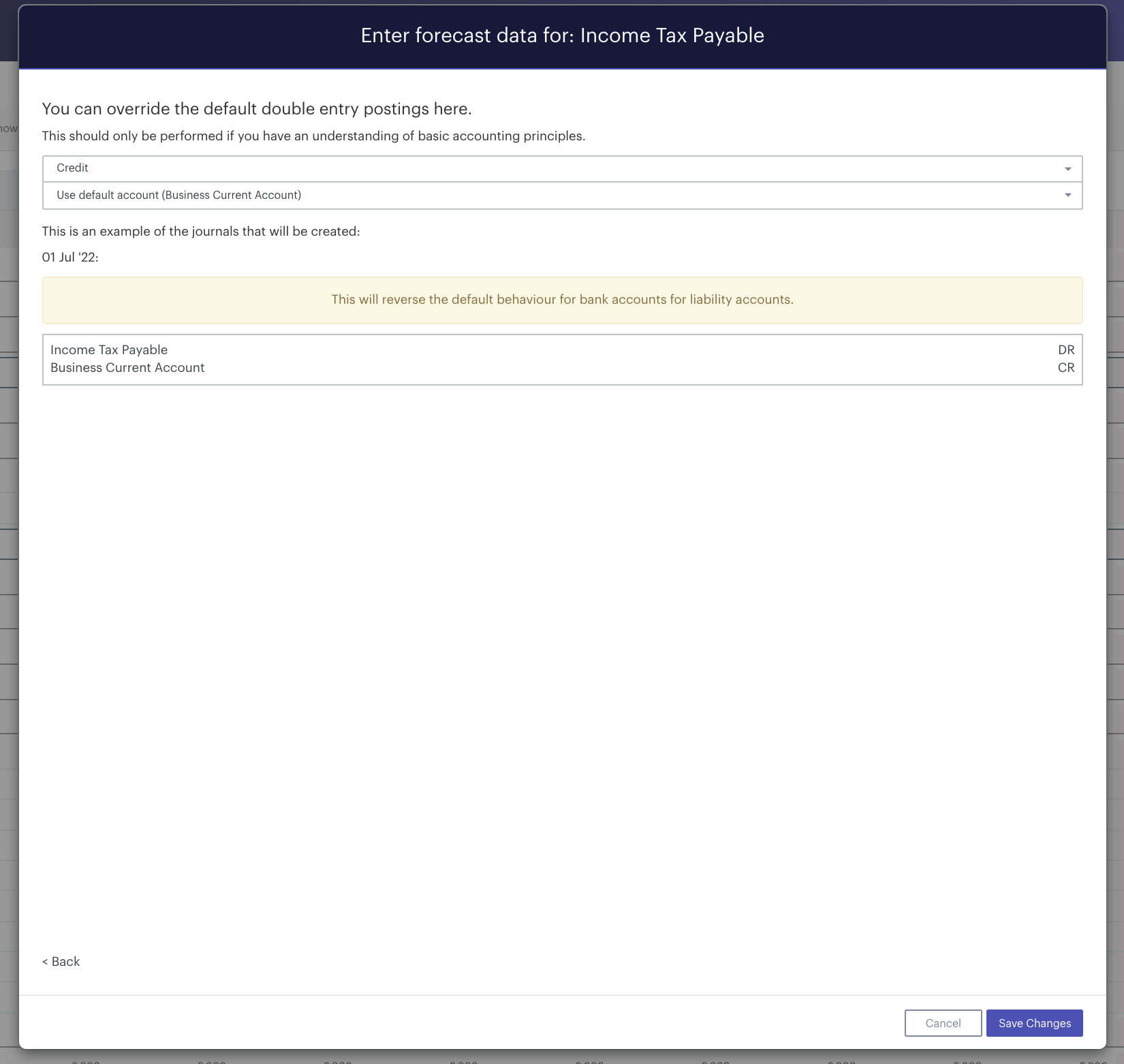

The last step is to hit the 'Override Journal Defaults' option and reverse the debit and credit by clicking the drop down menu 'Debit (default)' and selecting 'Credit' instead. This will reverse the journal entry so that we are reducing our liability by paying this with our bank account and your end result should be:

Once we have reversed the journal entry, hit ‘Save Changes’ to finally save this in our forecast.

After this has been saved, as long as there is a balance in your liability account, you should find that your income tax payments, will reoccur every quarter: