Have you ever been paid up front for services that will take place over a couple of months, or a job that might take a few months to complete? Let's show you how you might record that in your forecast, using deferred income.

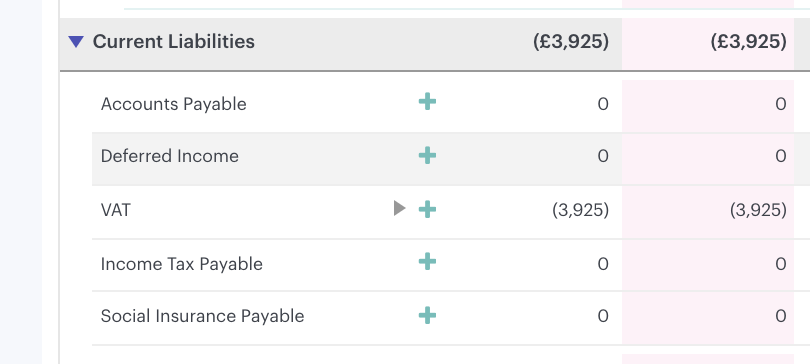

Deferred income is any revenue which is received in advance of a service being rendered or a product delivered to the purchaser. In accordance with the revenue recognition principle, cash received in advance is not recognised until the goods or services have been sent to or provided to the purchaser, at which point it will be represented as a source of revenue on the P&L. Until that point, cash received for the goods or services will be recorded as a liability on the balance sheet.

- - - - - -

Deferred income example

£2,460 worth of pre-orders are made in July for an item which is to go on general sale in August.

When monies are received in April, the transactions will be recorded as:

Debit: Bank accounts £2,460

Credit: Liabilities £2,460

In August when the items are delivered to the purchasers, the revenue paid will be represented on the P&L and the liability reduced to zero:

Credit: Sales £2,460

Debit: Liabilities £2,460

- - - - - -

Representing this in Futrli Advisor - recording the cash inflow

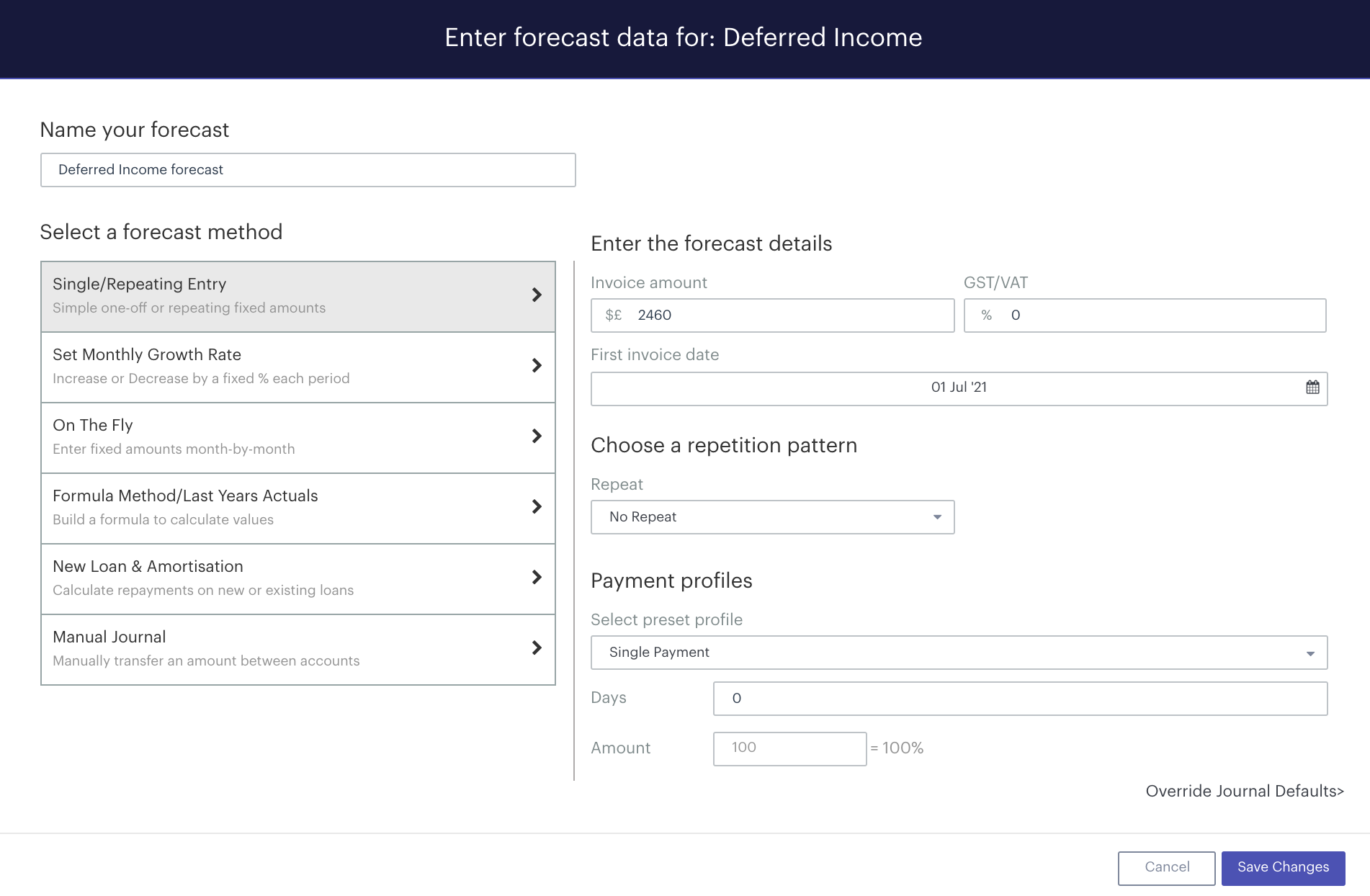

In Futrli Advisor, the above entries would be recorded by creating two forecast items, one against the appropriate liability account and one against the appropriate sales account. In the below example, we're going to enter the receipt of cash against our 'Deferred Income' line using the 'Single/Repeating Entry' method:

Step One

- - - - - -

Step Two

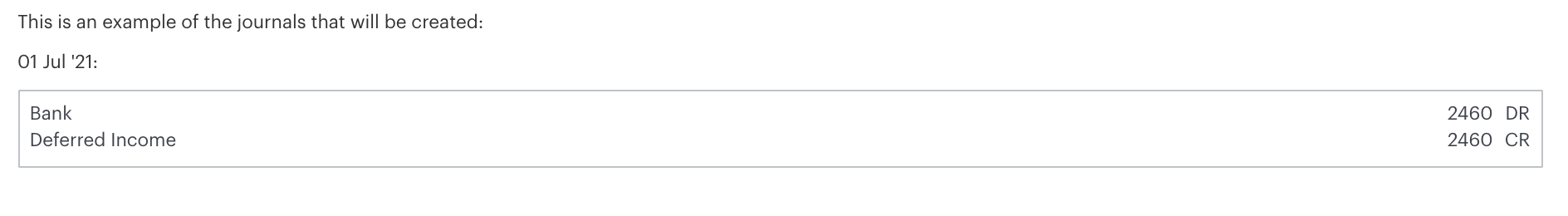

Here we are forecasting the receipt of £2,460 of cash on our 'Deferred Income' line:

This will debit our bank account by £2,460 and credit our deferred income account by £2,460.

- - - - - -

Recognising the revenue

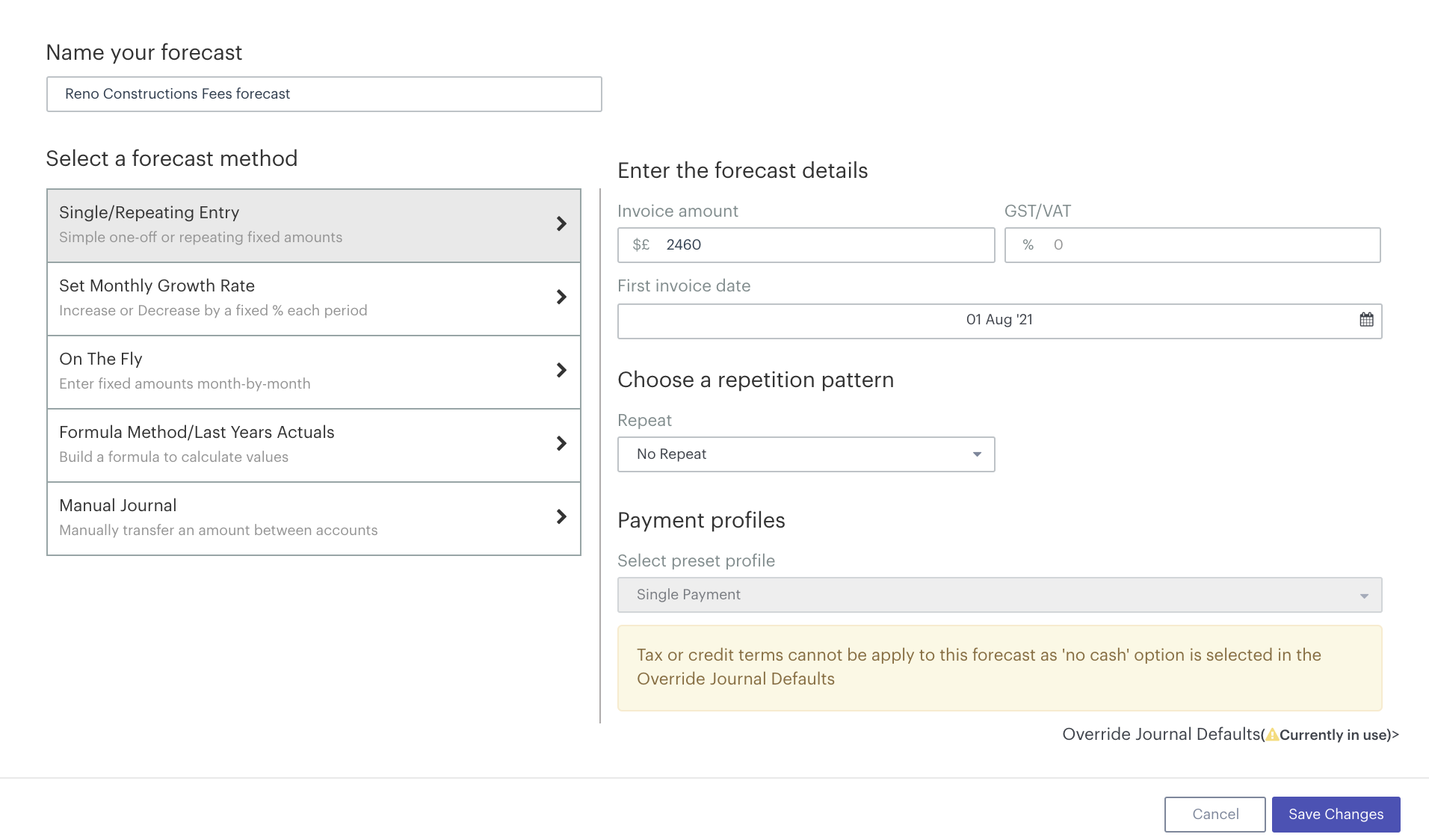

Step Three

We now need to enter a second forecast item to recognise this revenue in August (or over the number of months the work will be completed, which can be achieved by repeating the entry for the required number of months).

We would do this using the 'Single/repeating Entry' method on the income forecast line in question:

- - - - - -

Step Four

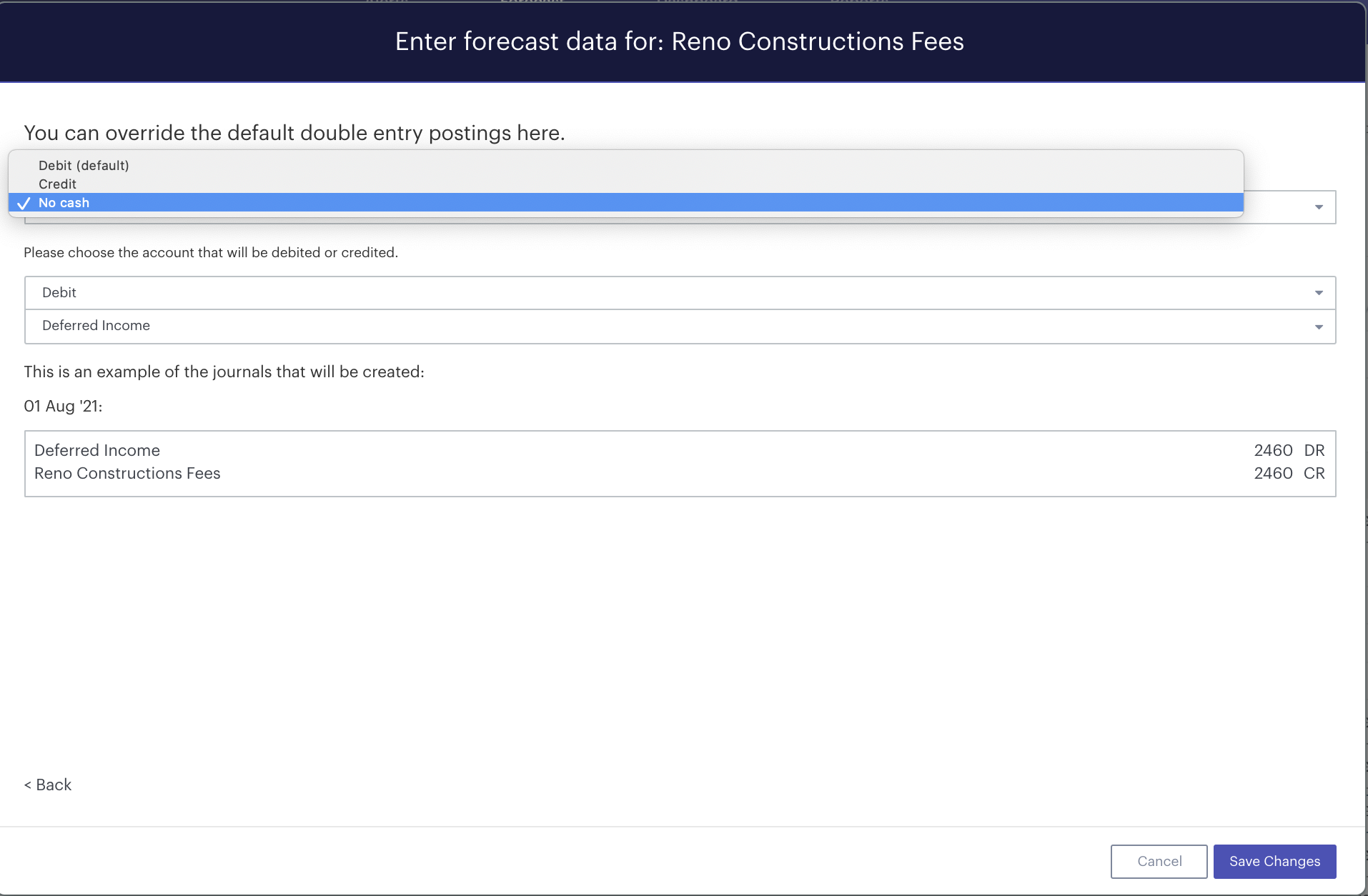

As we have already received the cash portion of this transaction, we need to enter this as a 'No Cash' transaction (we'll need to ensure GST/VAT and payment terms are set to zero to have access to this option).

To do this, we need to select 'Override Journal Defaults' at the bottom of the window and then 'No cash' from the first drop-down menu. As we are now recognising the pre-paid sales, we now also need to reduce the liability we created earlier to zero. To do this we simply select the deferred income line from the third drop-down menu:

This allows us to override the default behaviours and enter this as a 'No Cash' transaction.