When you create a forecast in Futrli Advisor, we'll source the opening balances of your Accounts Receivable, Accounts Payable and Sales Tax lines from the organisation's actual data.

The balance for each line will be taken from the closing balance of the last period prior to your forecast's start date.

Therefore, if you start your forecast in May, we'll be sourcing your balances as of April 30th. To ensure your forecast is accurate, we'll need to enter when we expect these balances to be paid.

In this guide, we're going to walk through creating a forecast item against an accounts receivable line, in order to account for the expected payment of a brought forward balance.

- - - - - -

Step One

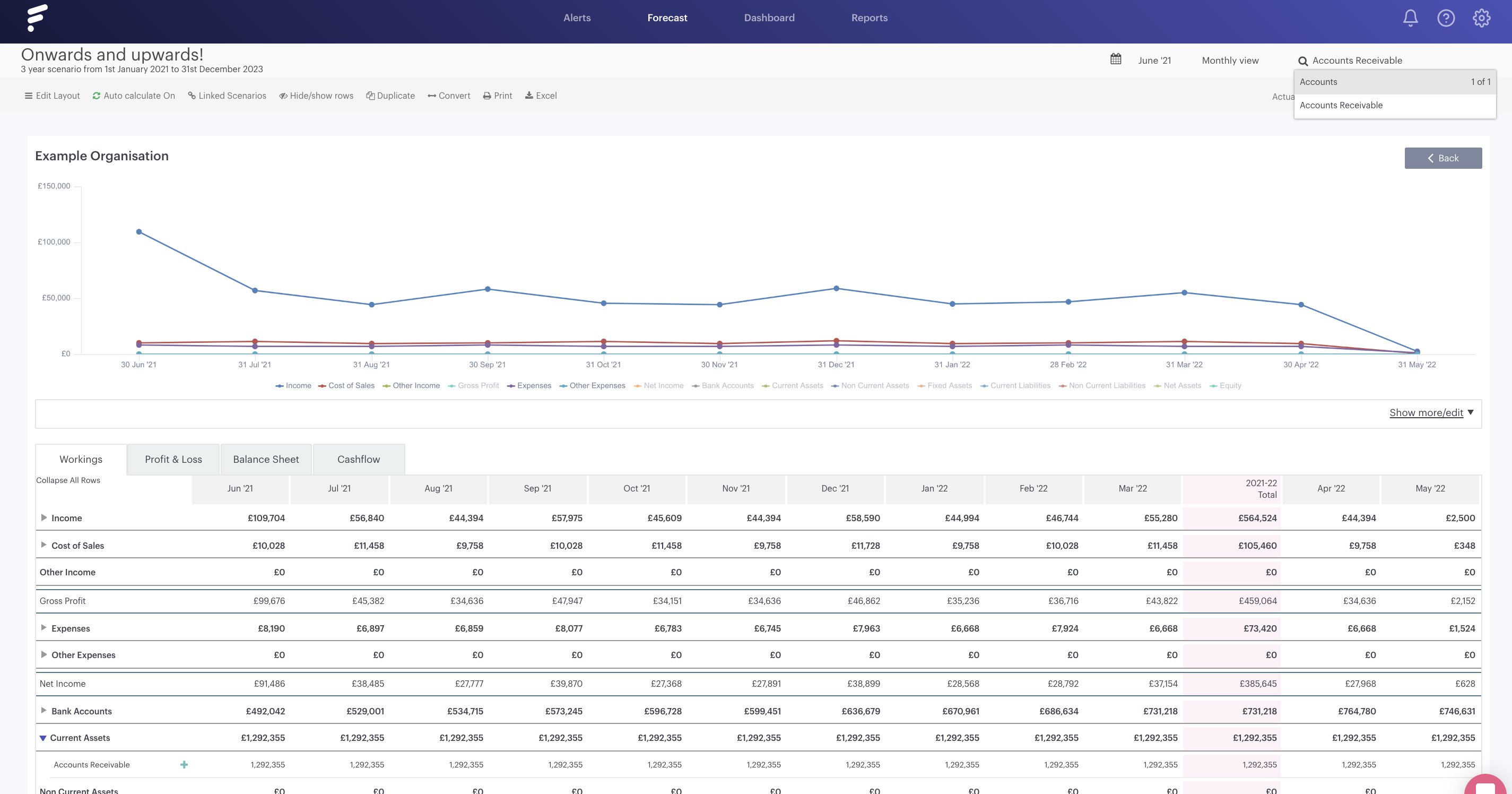

In this example, we're going to walkthrough receiving the payment of an existing balance on our accounts receivable line. To do so, we first need to navigate to where our accounts receivable line appears in our chart of accounts on the 'Workings' tab of our forecast:

Step Two

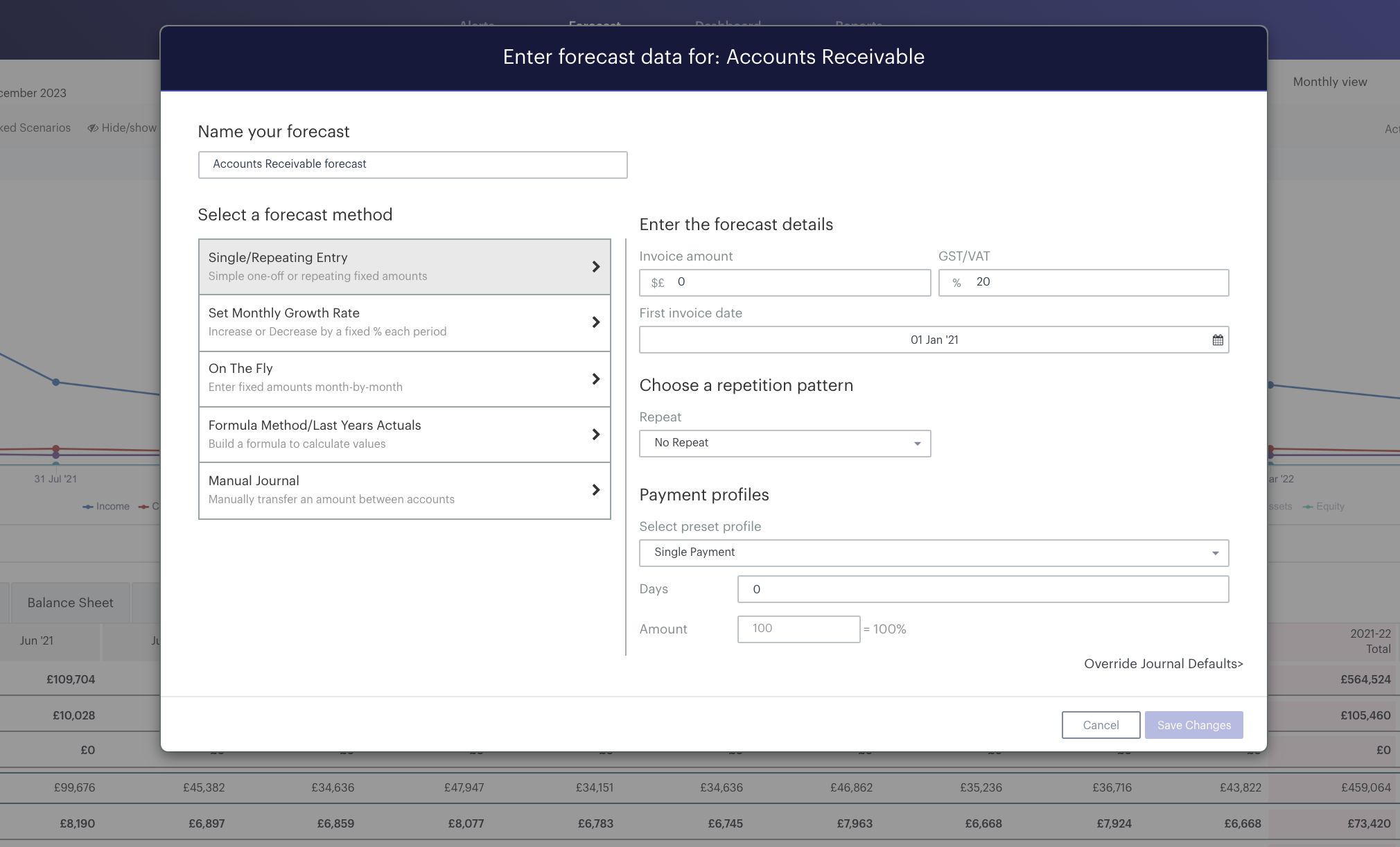

Futrli Advisor allows you to create forecast items against both profit and loss and balance sheet lines. We can enter a forecast item against our accounts receivable line by clicking the plus symbol:

Step Three

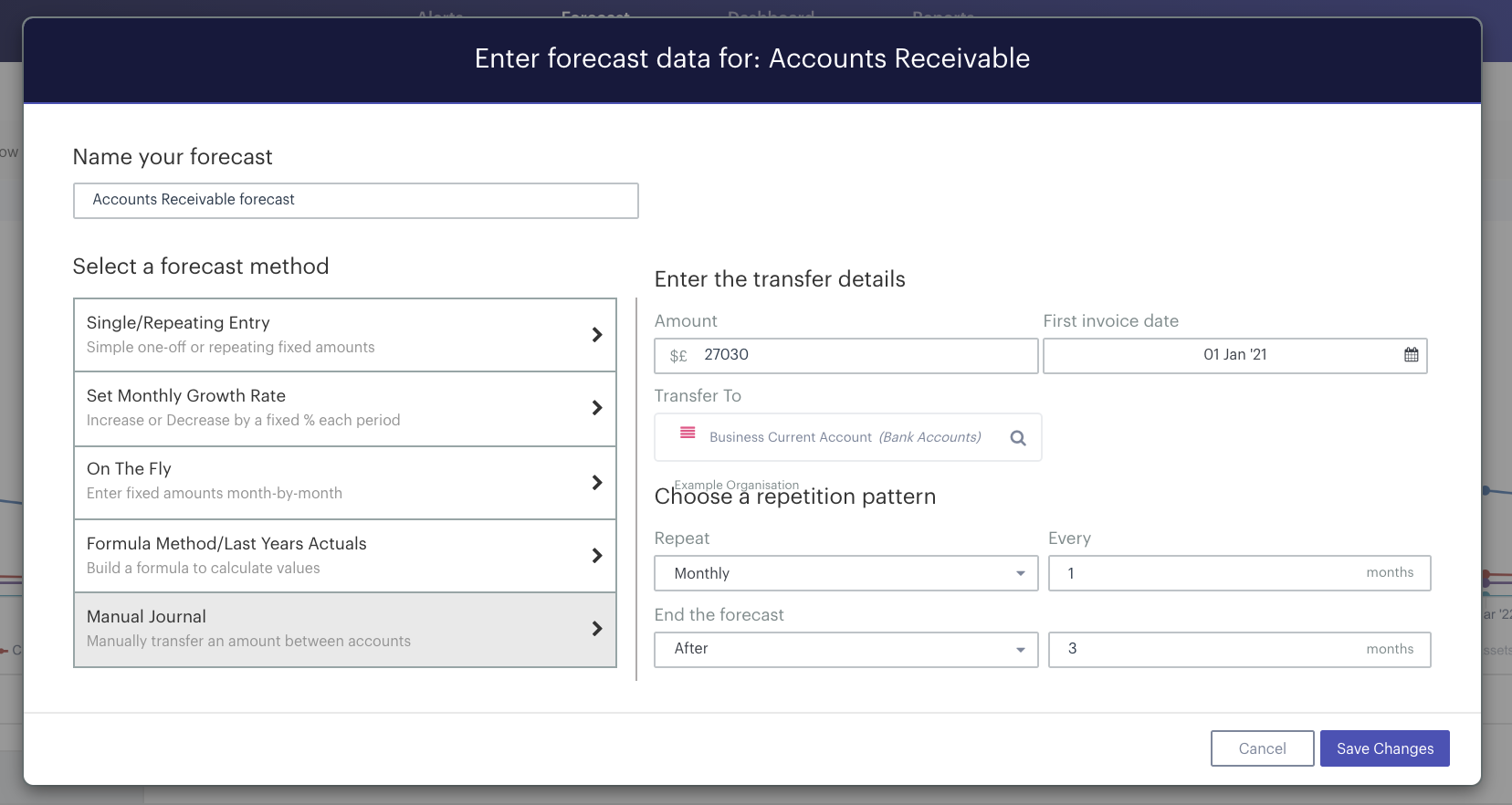

In this example, we anticipate that we'll be being paid in three instalments of £27,030 over the next three months. To enter this into a forecast item, we simply need to enter our anticipated amount in our 'Amount' column and the bank account we expect this money to be paid into, then the start date of our forecast and how often we wish to repeat it:

Step Four

After hitting 'Save Changes', we'll see each payment reflected in our cash flow.