What is depreciation?

It's a process in which the decline in value or the costs of tangible assets are allocated over the useful lifetime of the asset. When accounting for depreciation, the monthly depreciation expense of the asset is first calculated and then entered on both the profit and loss and balance sheet until the value of the asset either falls to zero or the asset itself is sold.

- - - - - -

What is an asset?

An asset could be anything from a laptop for an employee, company van or even property owned in the company name. These are physical items and do consider tangible, as opposed to ‘intangible’ such as copyrights or patents.

- - - - - -

Example using the straight-line method

The straight-line method is the most common method of calculating depreciation. Under the straight-line method, depreciation of the asset is recorded evenly across its useful life, with depreciation expense calculated as:

(Cost of asset - residual value of asset) / estimated useful life of asset

If we were to purchase an asset for £10,000, with a residual value of £500 and that asset had a useful lifetime of 4 years, then using the straight-line method we would calculate our monthly depreciation expense as follows:

(£10,000 - £500) / 4

£9,500 / 4

£2375 per annum

£2375 /12

£197.92

When accounting for first taking on the asset we would make the following Journal entry:

Credit: Bank Accounts £10,000

Debit: Fixed Assets £10,000

Depreciation of the value of the asset would then be recognised monthly as:

Debit: Depreciation Expense £197.92

Credit: Accumulated Depreciation £197.92

- - - - - -

Representing this in Futrli

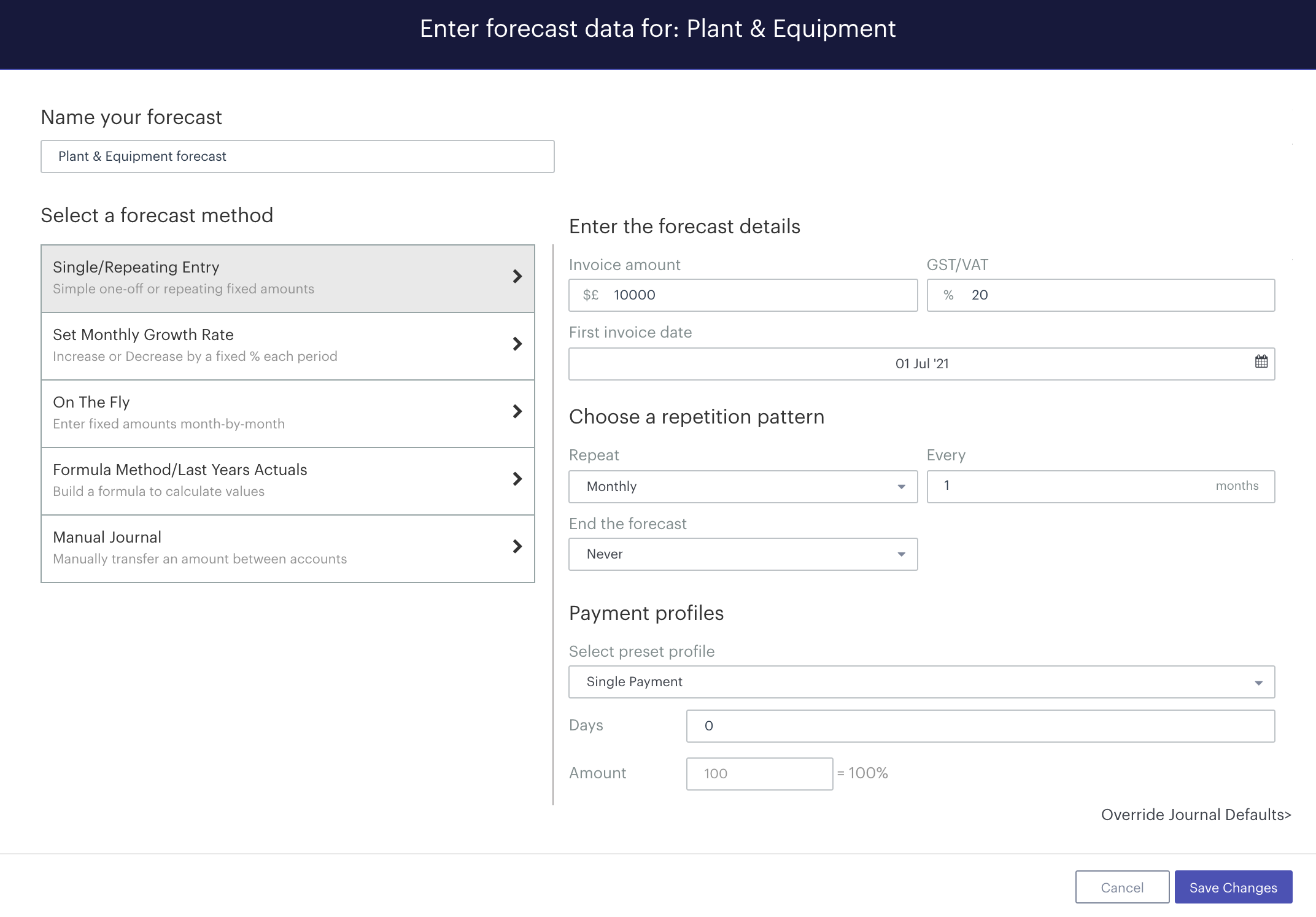

In Futrli Advisor, the above entries would be recorded by creating two forecast items, one against the appropriate fixed asset line and one against the appropriate depreciation expense line on the profit and loss. In the below example, we're going to enter the purchase of the asset against our 'Plant & Equipment' line using the single/repeating entry method:

Here we are forecasting the purchase of a new asset valued at £10,000:

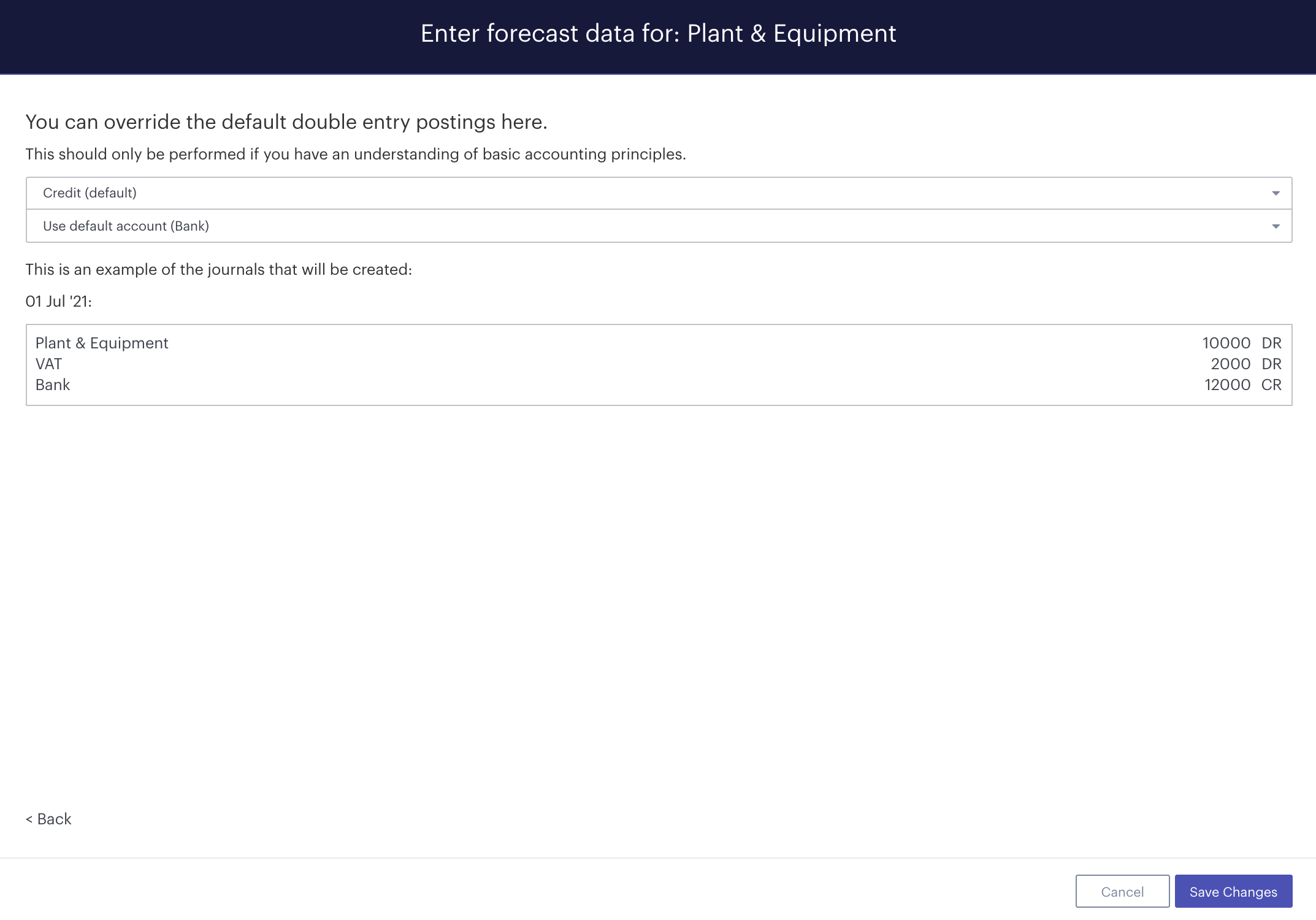

This will debit our chosen fixed asset's line by £10,000 and our GST/VAT line by the sales tax amount and credit our bank account by £10,000 + the VAT amount (if applicable).

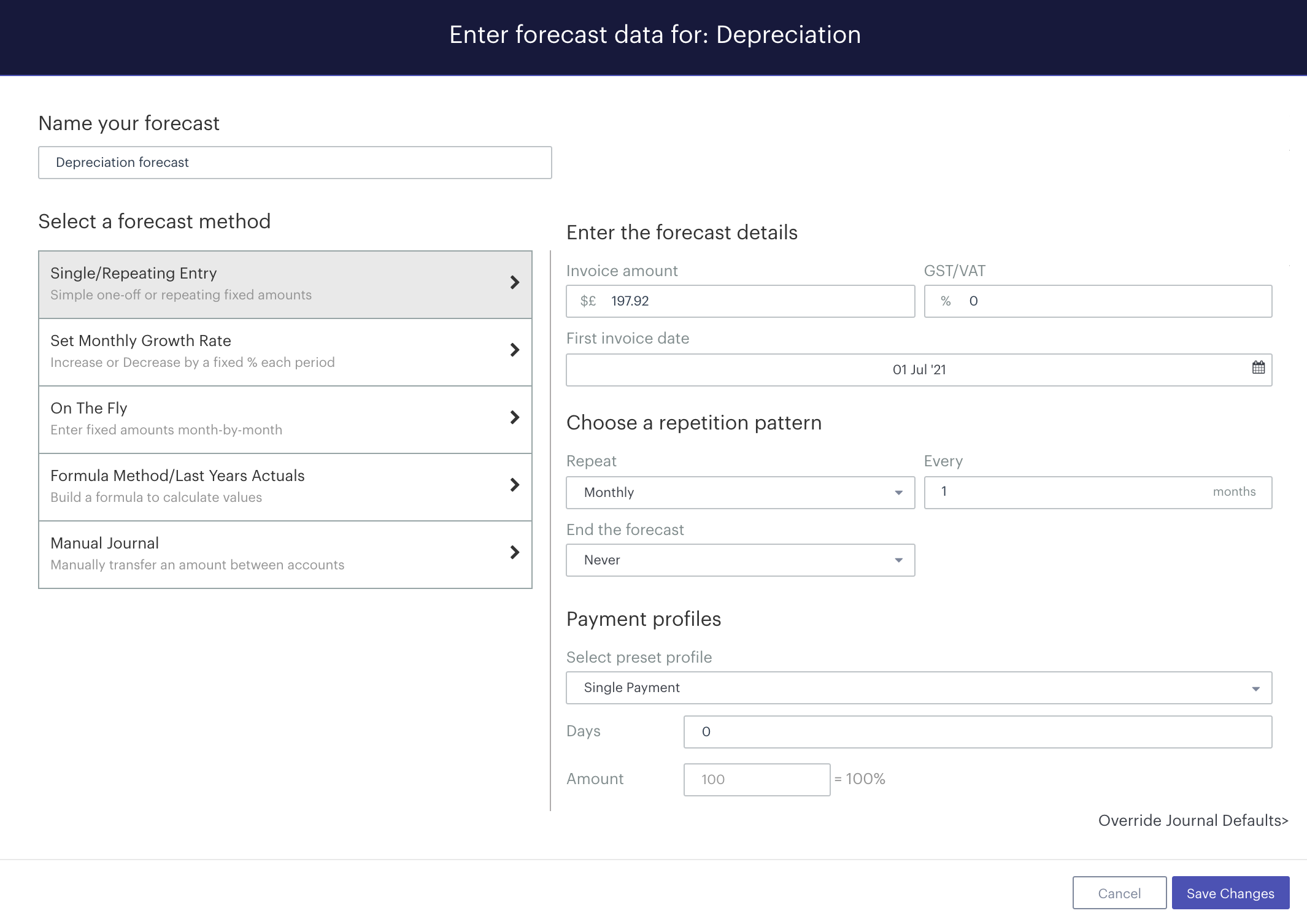

We now need to enter a second forecast item to account for monthly depreciation. We would do this using the single/repeating entry method on the appropriate 'Depreciation' expense line:

Once we have created our Depreciation expense forecast item, we'll need to ensure it does not impact the bank account. To do this, we firstly need to ensure GST/VAT and payment terms are set to zero.

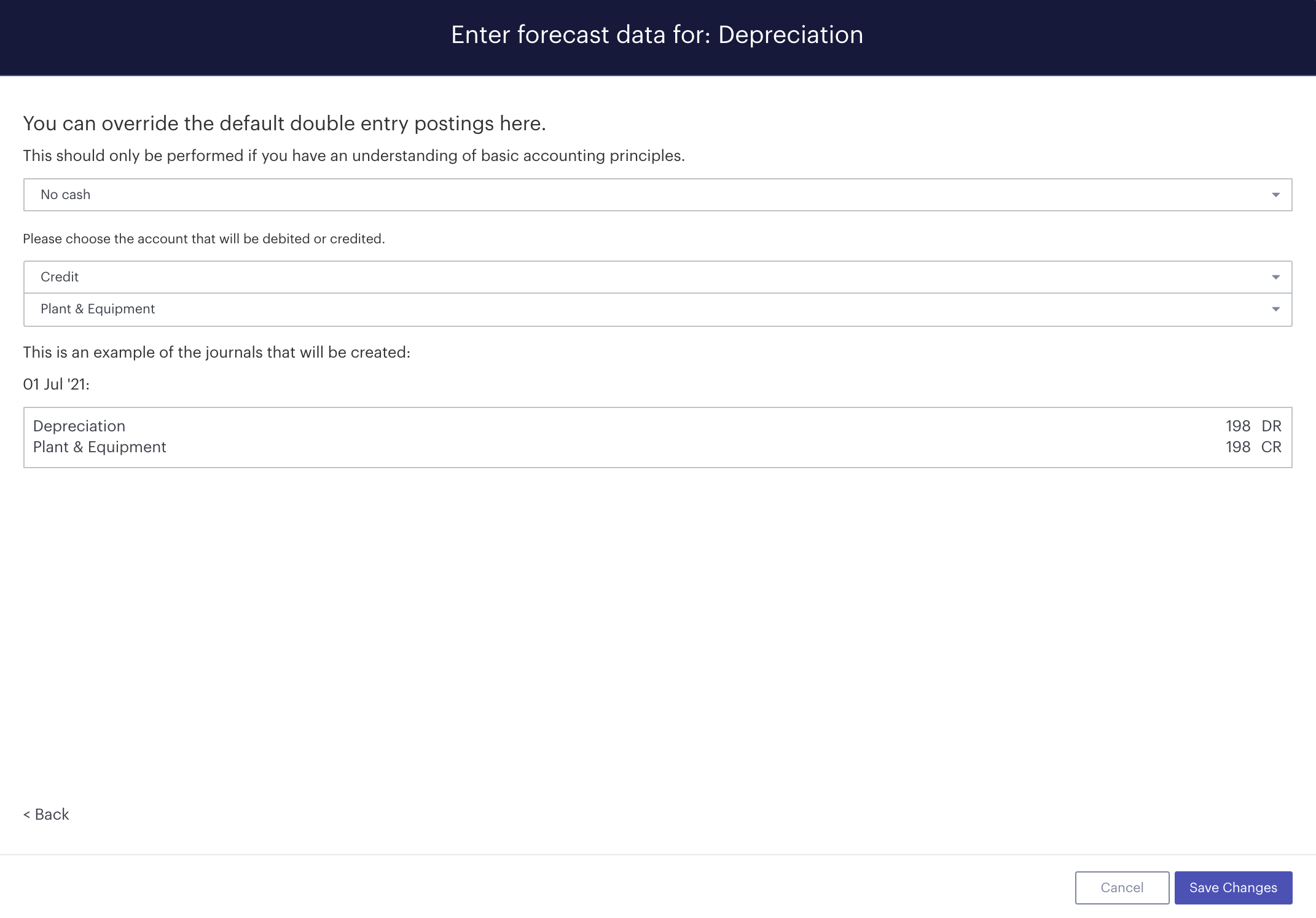

The next step is to select 'Override Journal Defaults' at the bottom of the window and then 'No cash' from the first drop-down menu.

As we also need to account for accumulated depreciation on the balance sheet, we would now select the appropriate accumulated depreciation line from the third drop-down menu:

This allows us to override the default behaviours and enter this as a 'No Cash' transaction.