This help guide runs through the process of invoice factoring with recourse.

In this example, we're going to forecast a £5,000 sale on the 1st of February, the invoice value of which we will be selling in order to receive an immediate cash boost. We will be receiving 70% of the value of the invoice (£3,500) upfront at a fee rate of 5% (£250) with a recourse liability of £500. The remaining value (£750) will be being paid once the customer has paid their original invoice, totalling £5,000, which we anticipate will be 60 days after the 1st of February.

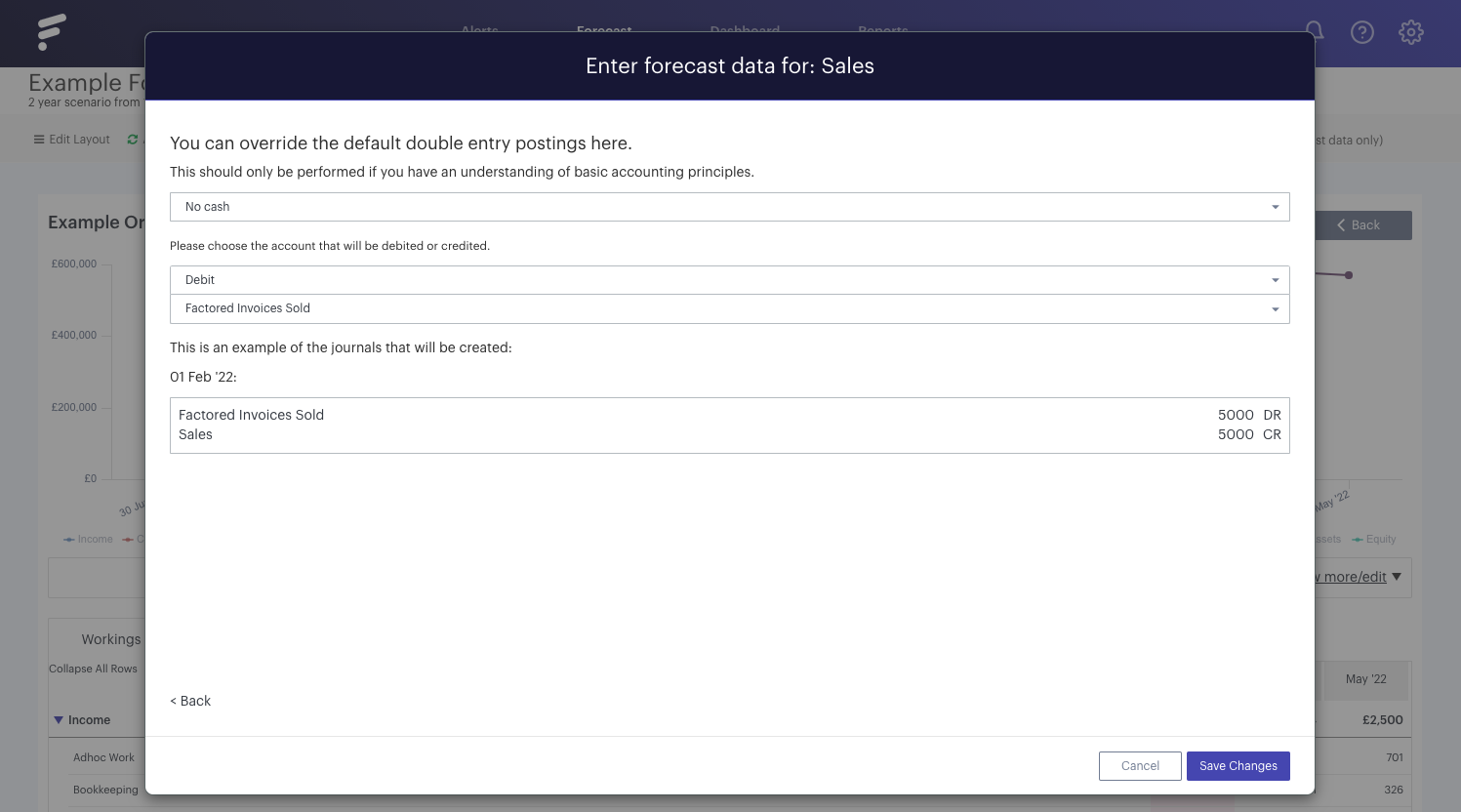

First, we're going to forecast the £5,000 sale. To do so, we need to create a forecast item against our 'Sales' line for the 1st of February, with the value of £5,000:

As we're going to be selling this invoice, we're going to be using the advanced options to handle the balance sheet movements for this item. As a result, we will be leaving the credit terms at zero and instead of marking this as a 'No Cash' entry, so that we can push the £5,000 to the asset line on which we will be handling our invoice factor.

To do this, we select 'Override Journal Defaults', select 'No Cash' from the first drop-down menu in the advanced screen and then select the appropriate asset account to be debited - in our example we're using 'Factored Invoices Sold':

This will cause £5,000 to be debited in our 'Factored Invoices Sold' account on the 1st of February.

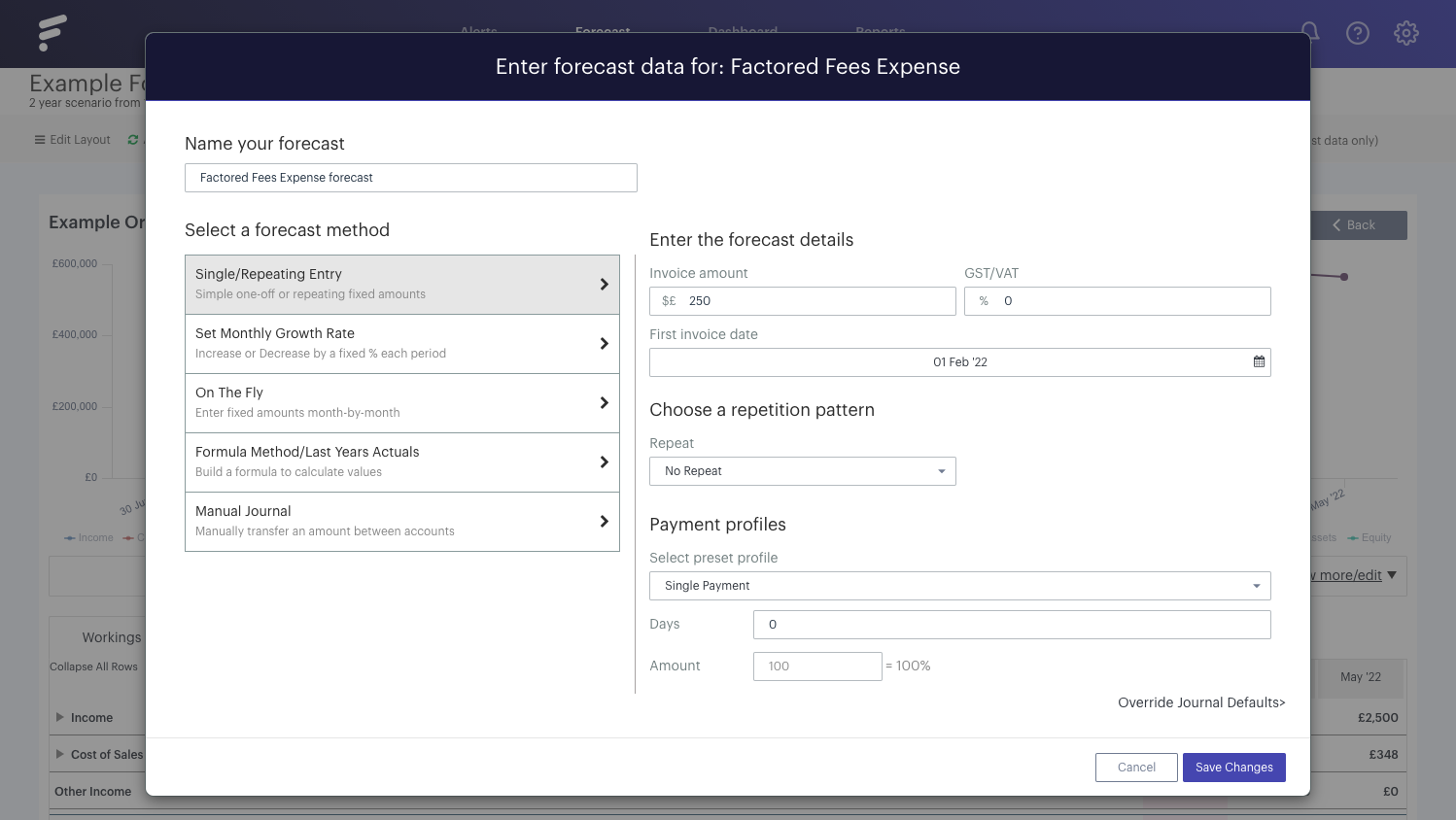

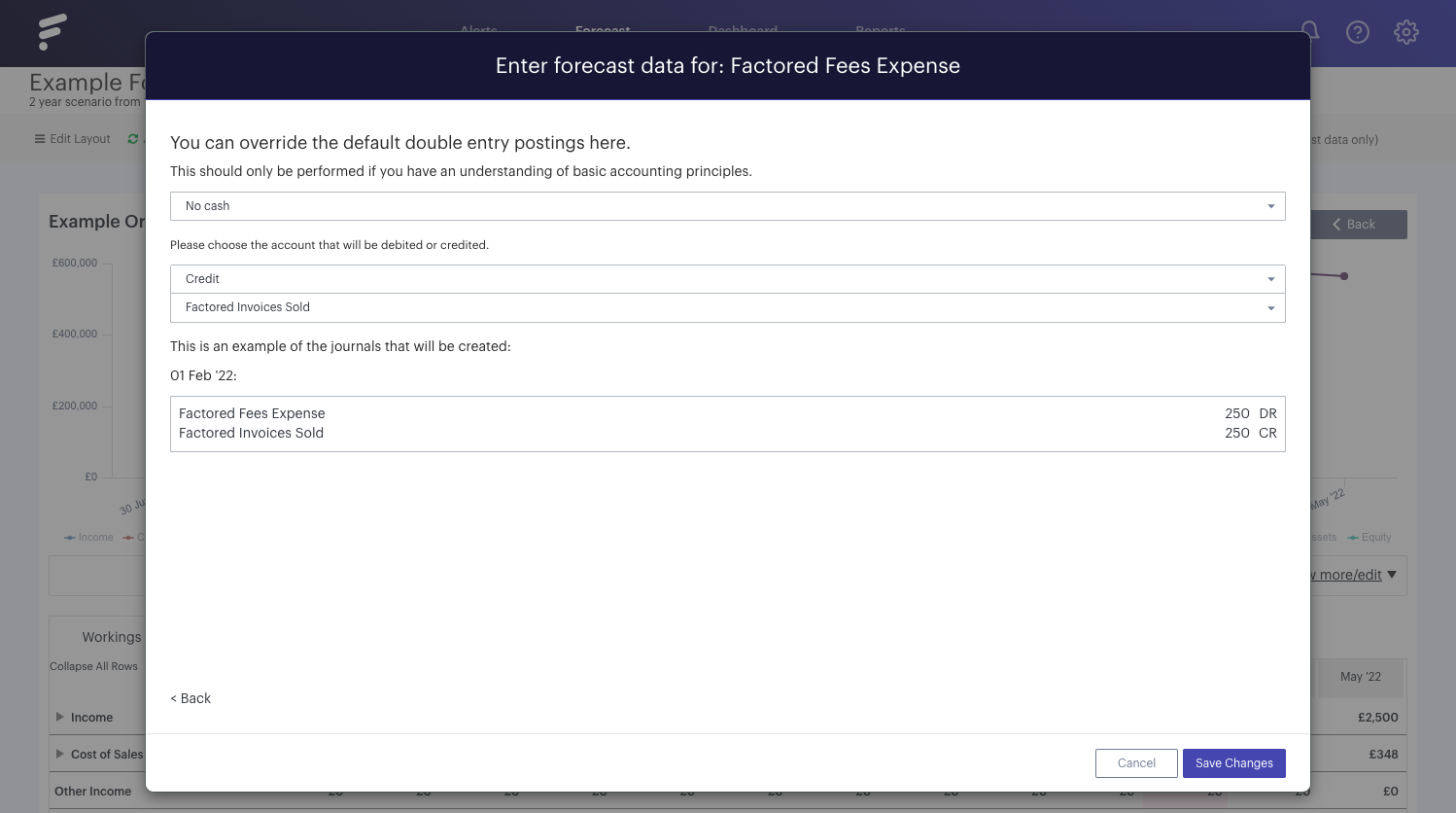

As we'll be paying a fee of 5%, we next need to enter an expense for the value lost due to selling our debt up front. To do this, we're going to scroll to the appropriate expense account and enter a transaction dated the 1st of February for the value of £250:

As with our 'Sales' invoice, we'll be entering this as a 'No Cash' item, which will be reducing the value of our asset line, 'Factored Invoices Sold':

If we now navigate to our asset line, we'll find it being increased by the £5,000 value of our original sale and decreased by our cost of £250. We now need to mark the receiving of cash on the 1st of February (our £3,500).

At the same time we're going to forecast the value we anticipate receiving 60 days later when the invoice is paid by the customer. As we anticipate the customer will only pay £750 of their obligation, we will be forecasting receiving £750 rather than the total £1,250 owed.

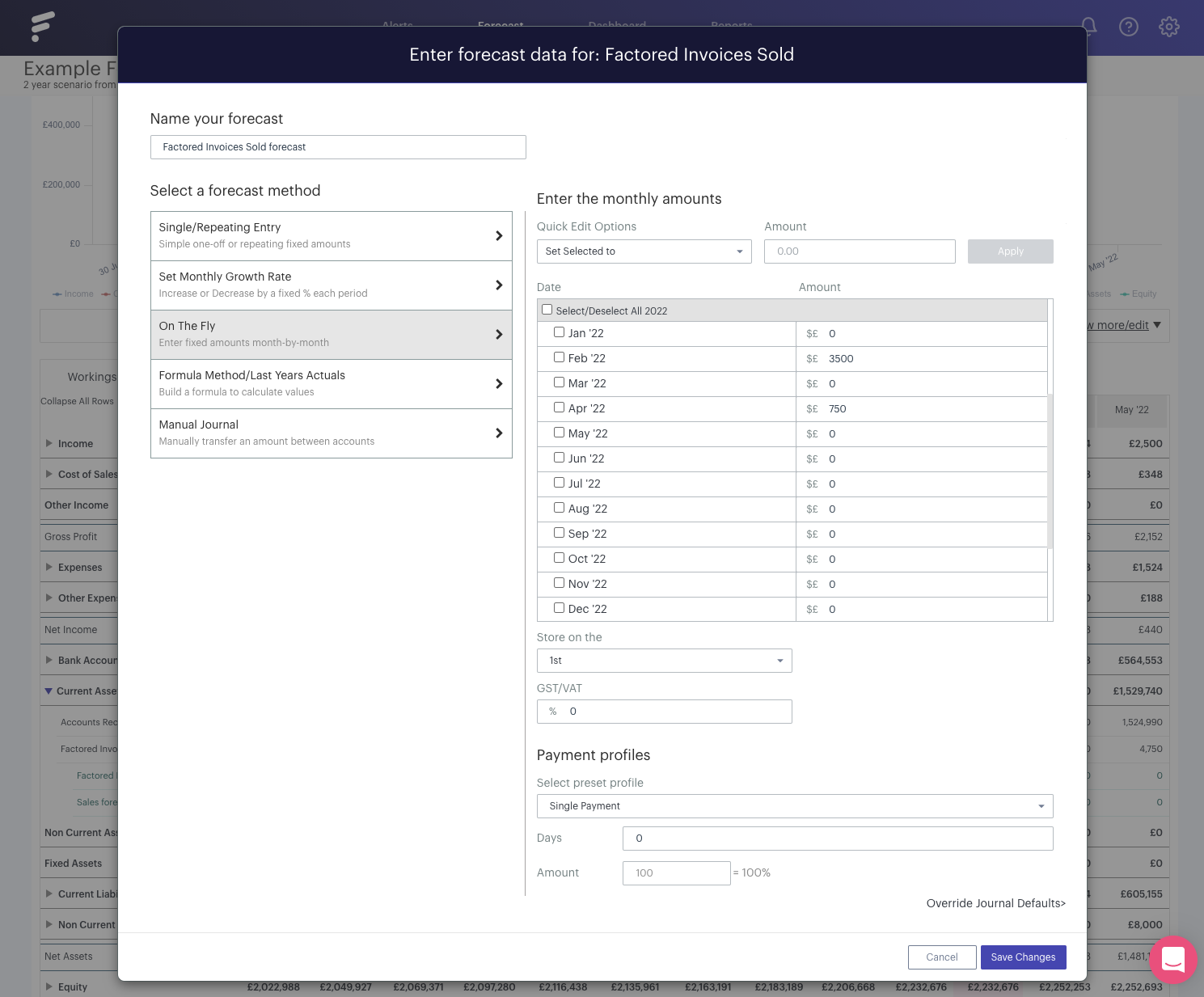

To do this we're going to create a new forecast item against our 'Factored Invoices Sold' line using the 'On the Fly' method. Against February we're going to enter our value of £3,500 and against April our value of £750:

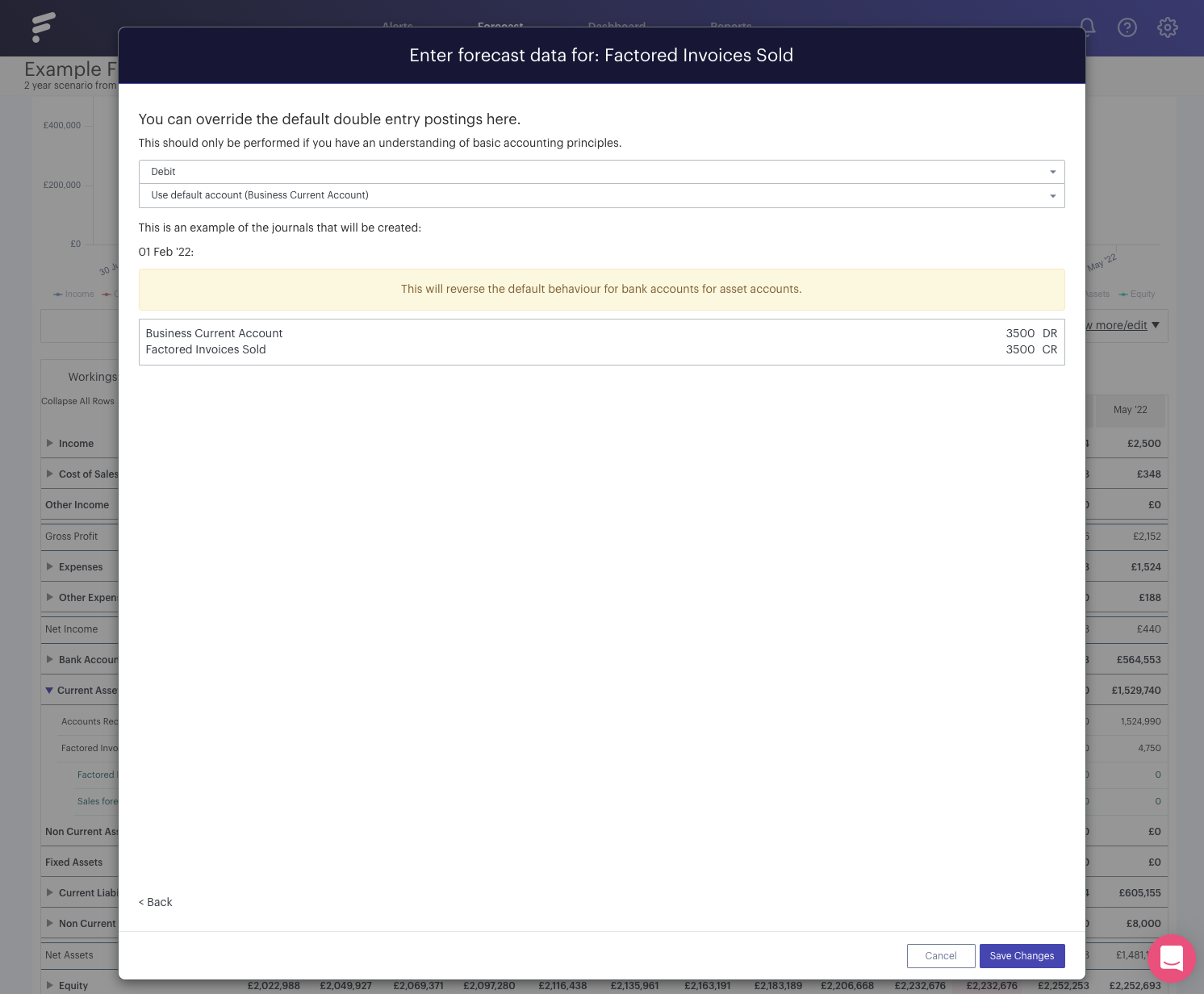

We're now going to select our 'Override Journal Defaults' option again in order to reverse the behaviour of this transaction so that it is entered as a debit rather than a credit:

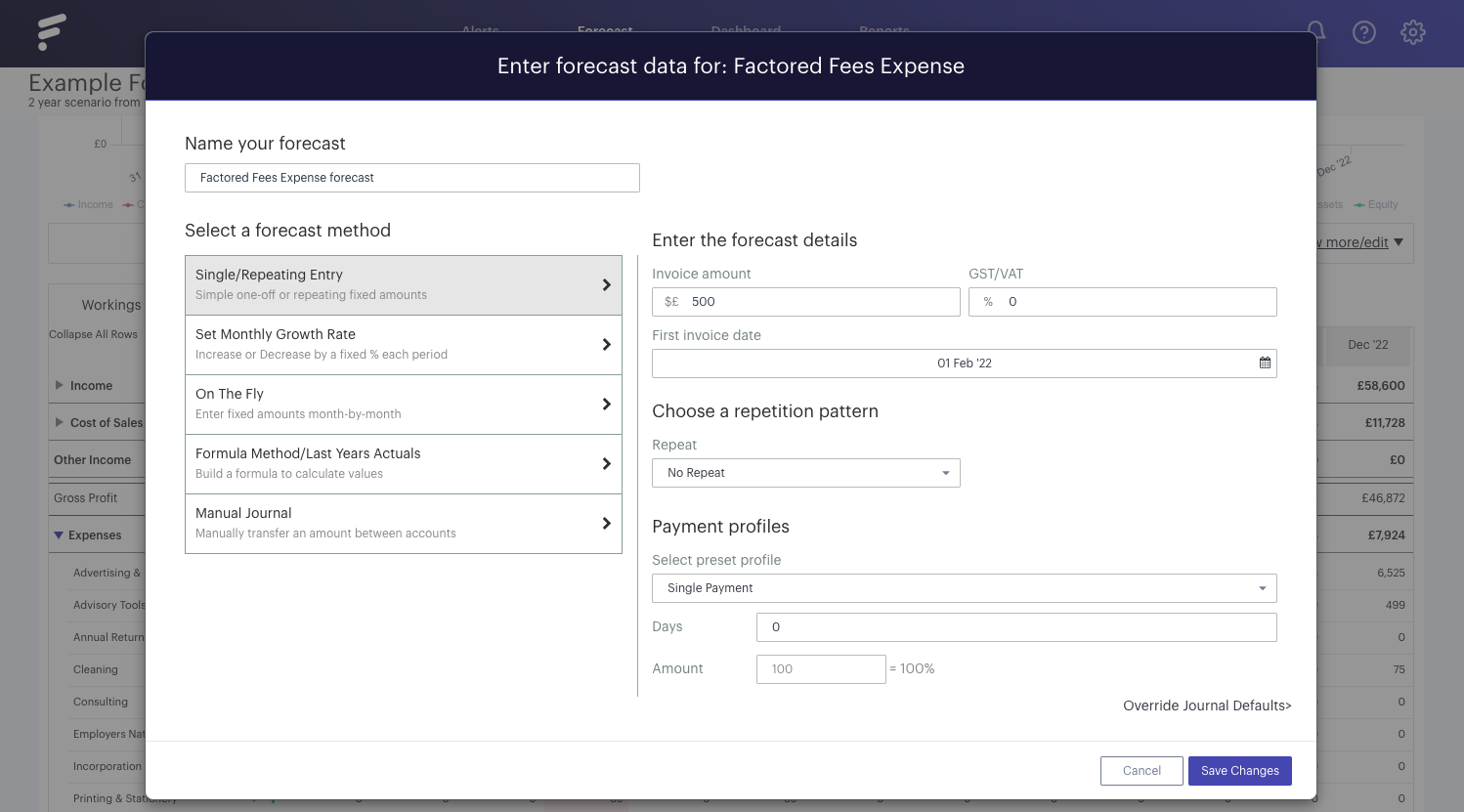

This will leave us with £500 left over on our 'Factored Invoices Sold' line. As we forecast that this value will not be being paid by the customer, we need to mark this as an expense on our profit and loss. To do so we're going to create another forecast item against our 'Factored Fees Expense' line, this time for the value of £500:

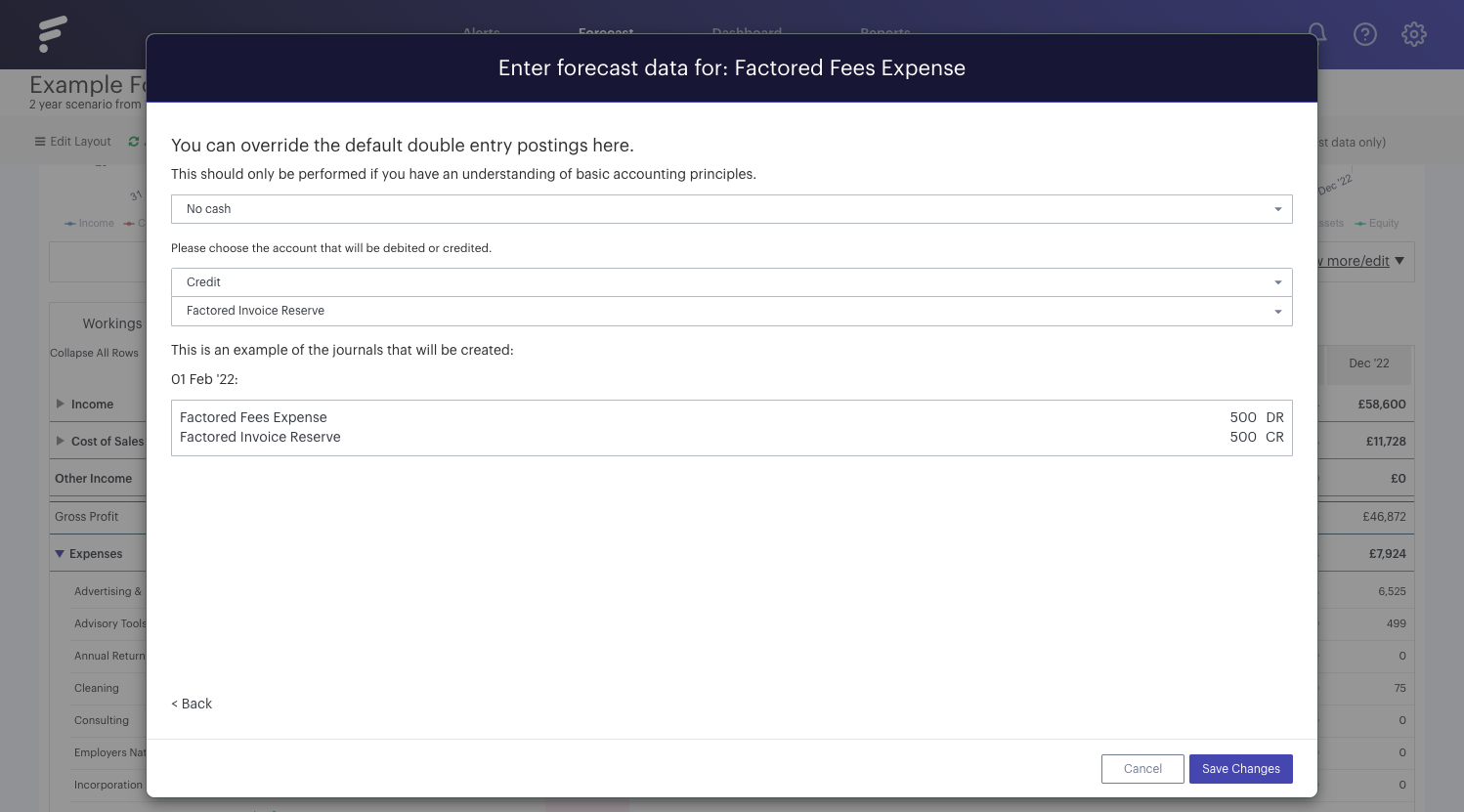

Once again we're going to select 'Override Journal Defaults'. We're going to be entering this as a 'No Cash' entry which will credit our contra-asset account, 'Factored Invoice Reserve':

This will now cause us to have a negative value of £500 on our 'Factored Invoice Reserve' line and a positive value on our 'Factored Invoices Sold' line. In our final step we need to cancel these two items out, as we will be writing off the amount unpaid.

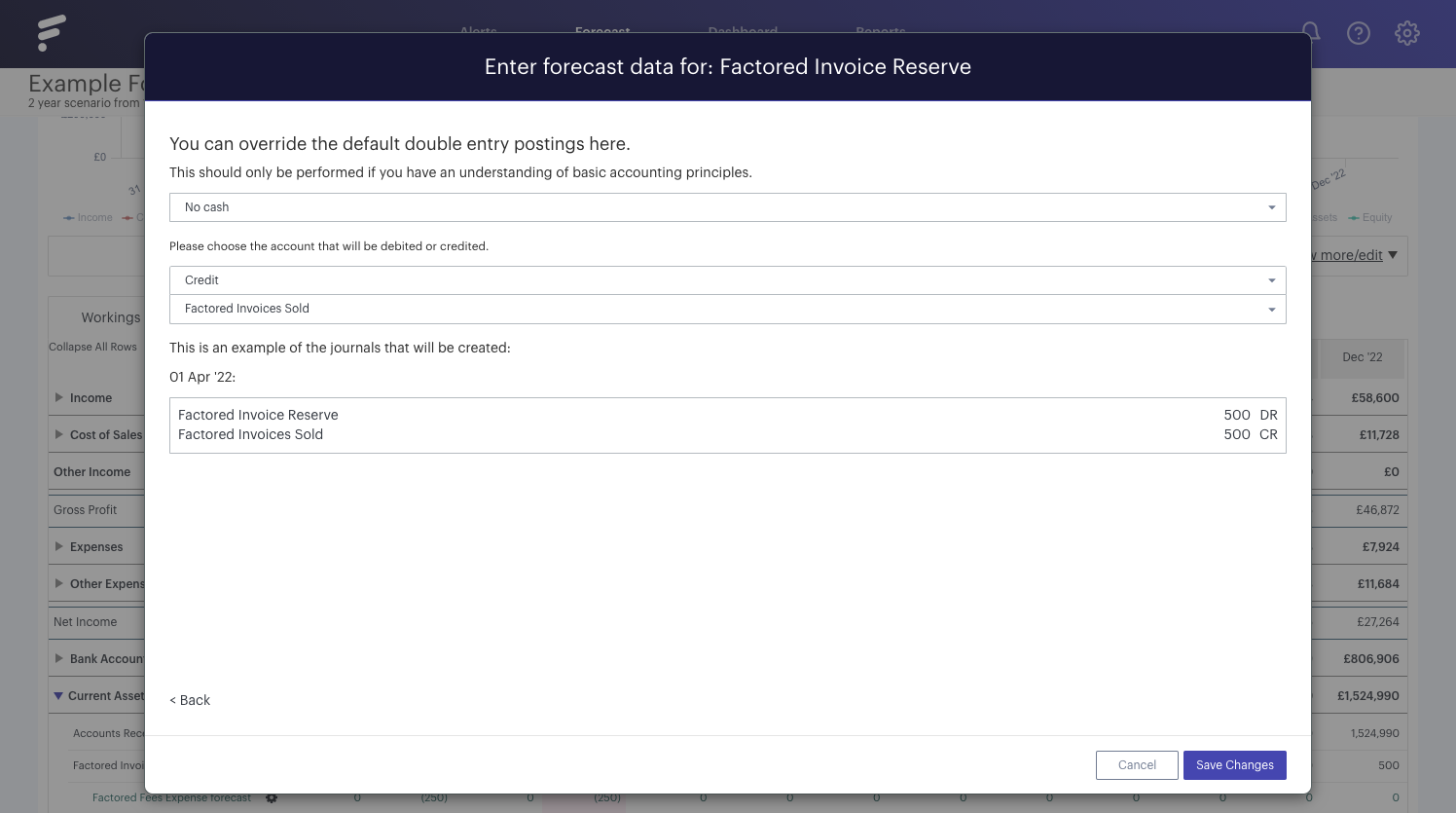

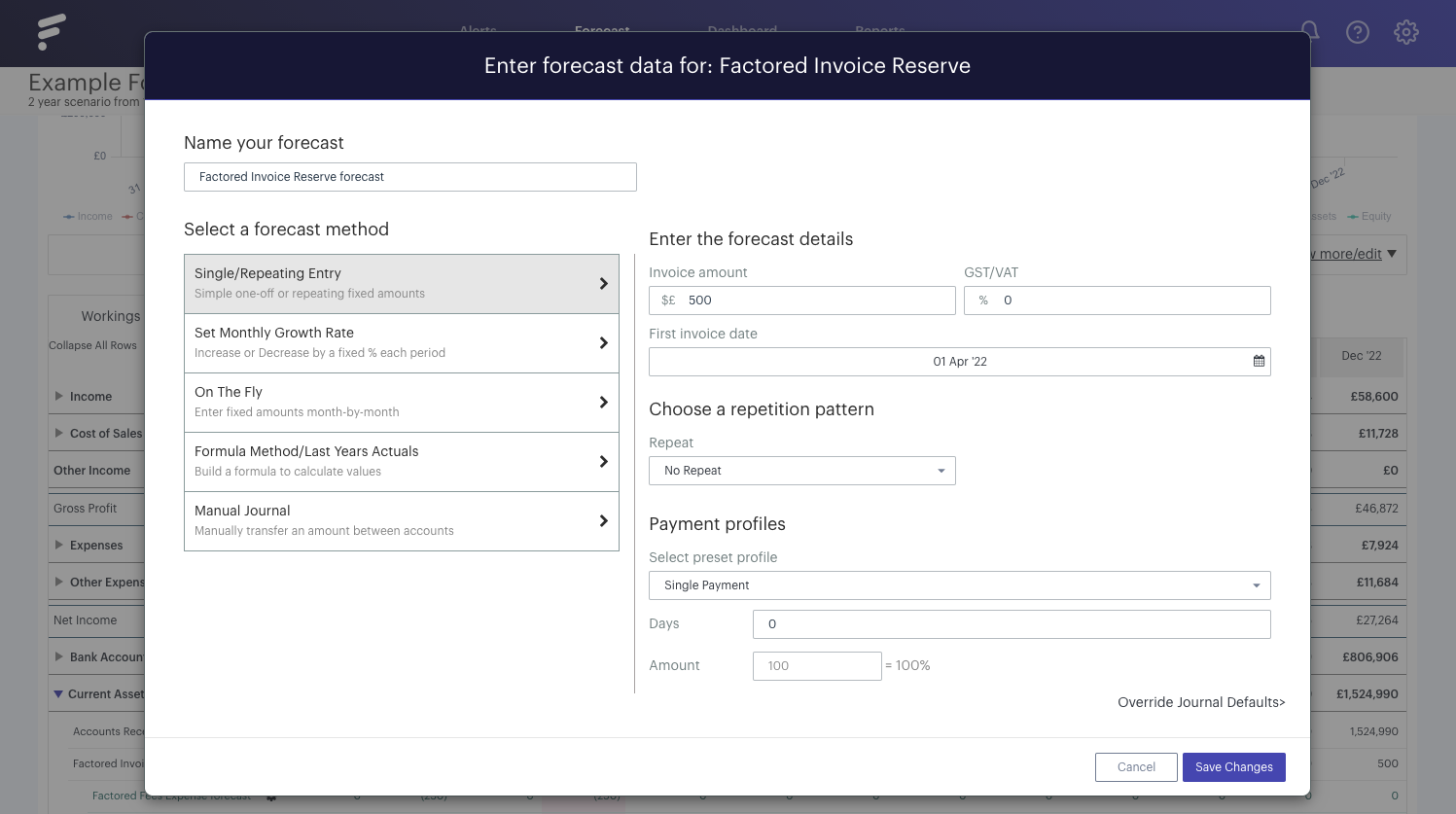

To do so we create a forecast item on our 'Factored Invoice Reserve' line totalling £500, dated April 2022:

Using our 'Override Journal Default' option, we then select 'No Cash' and credit our 'Factored Invoices Sold' line in order to reduce both lines to zero: