In this example we’re going to look at a payroll scenario in which we wish to record gross wages on our profit and loss as occurring on one date, but will need to make our actual net wages, PAYE and National Insurance payments on separate dates.

To do this we’re going to use Futrli Advisor's 'Override Journal Defaults' option to enter our initial forecast as a 'No Cash' item and then handle our payments separately on the balance sheet.

- - - - - -

Recording gross wages as a 'No Cash' item

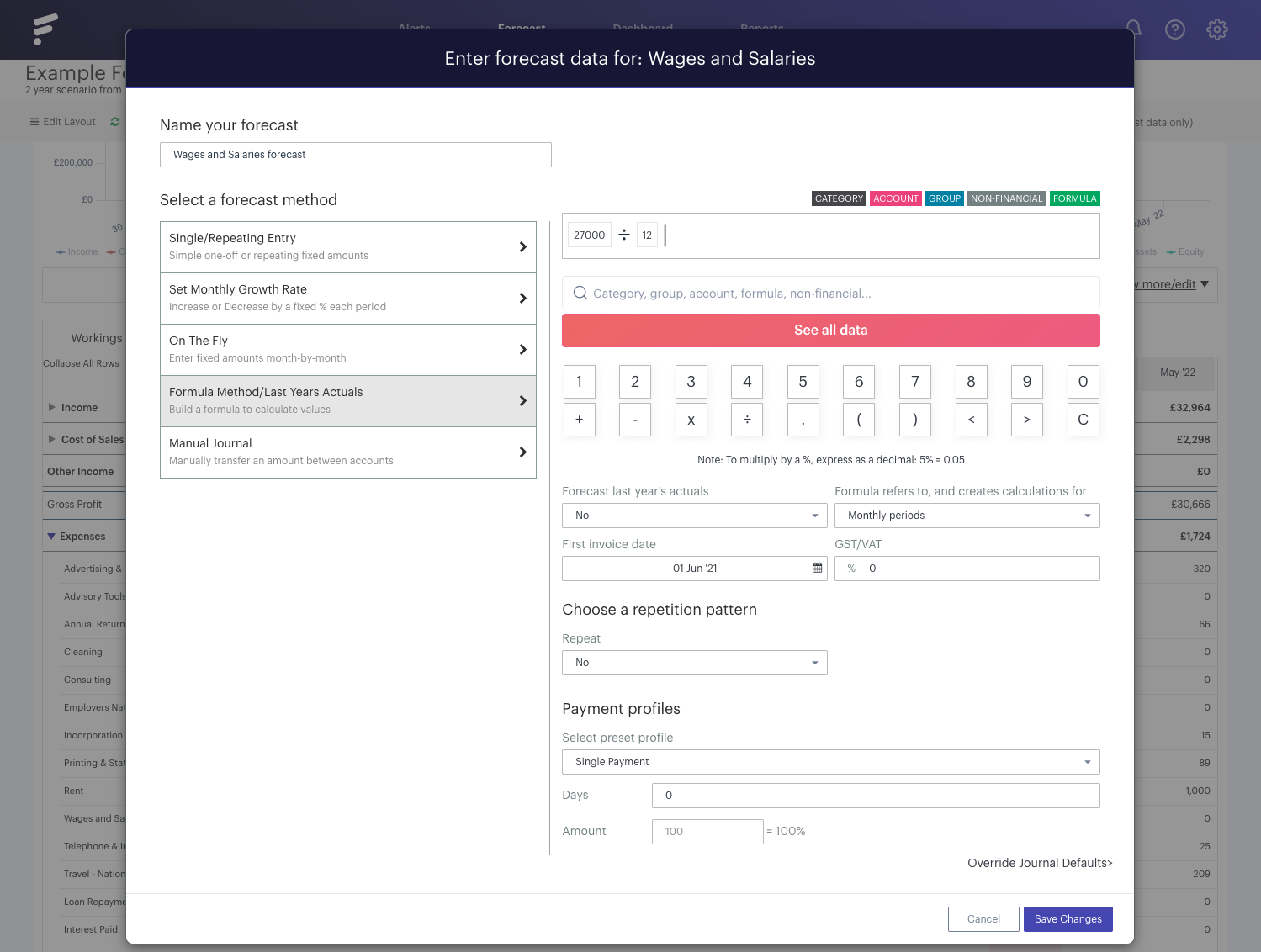

First, we need to create a new forecast item against our 'Wages and Salaries' line. In this example, we have one staff member, Sally who earns £27,000 per annum. We’re going to rename our forecast item to give ourselves visibility over what we are forecasting and then select the formula forecast method. Here we’re going to enter our gross wages as 27,000 divided by 12:

We’re going to enter this as a monthly recurring payment with no GST/VAT and no credit terms. This is important, as we will be handling the actual payment terms on the balance sheet.

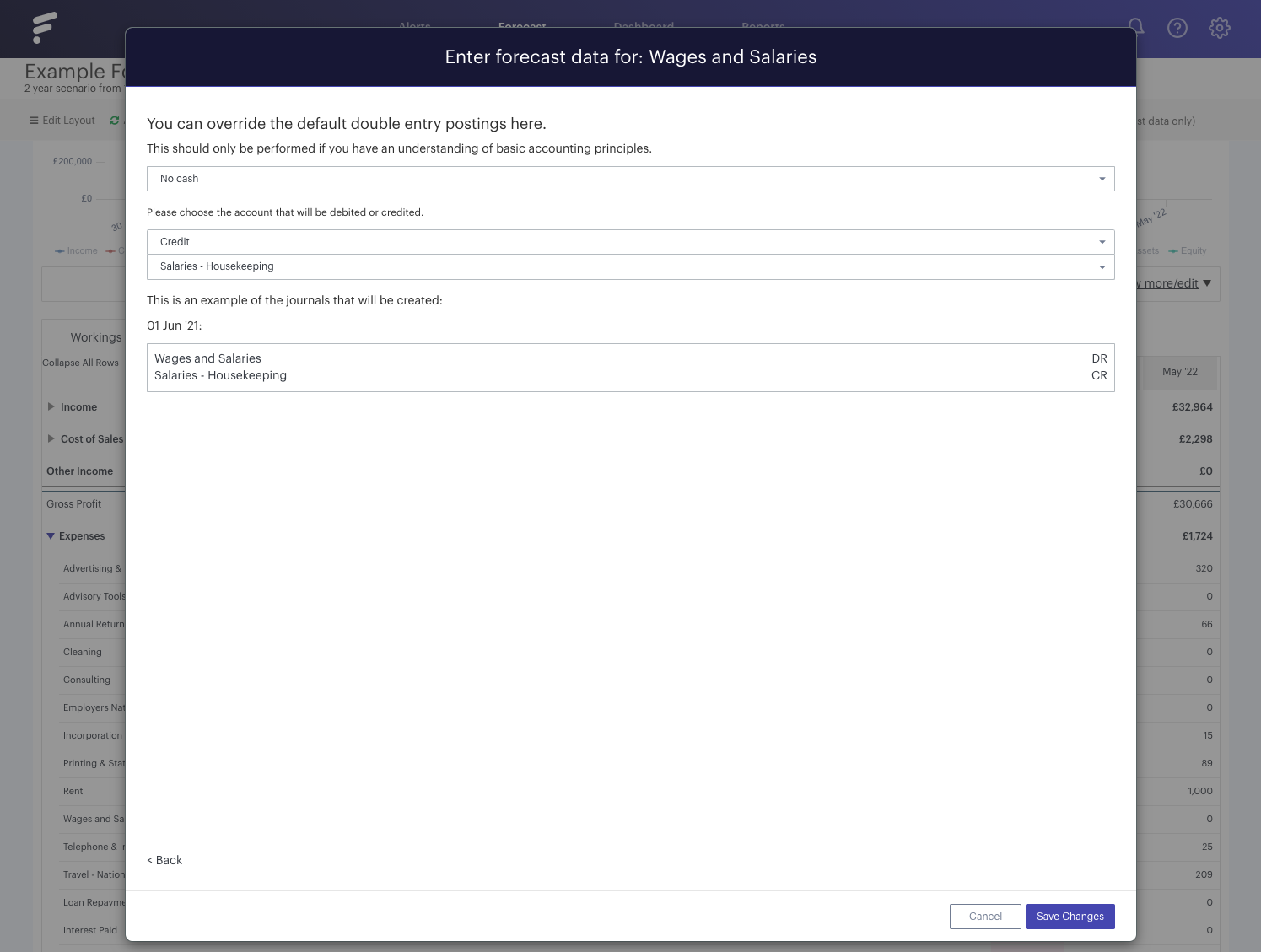

Click 'Override Journal Defaults' in the bottom right of the window and then in the first dropdown menu select 'No Cash'. In the second dropdown menu we’re going to credit our 'Salaries - Housekeeping Payable' account on the balance sheet and then save by selecting 'Save Changes':

- - - - - -

Entering payment terms on the balance sheet

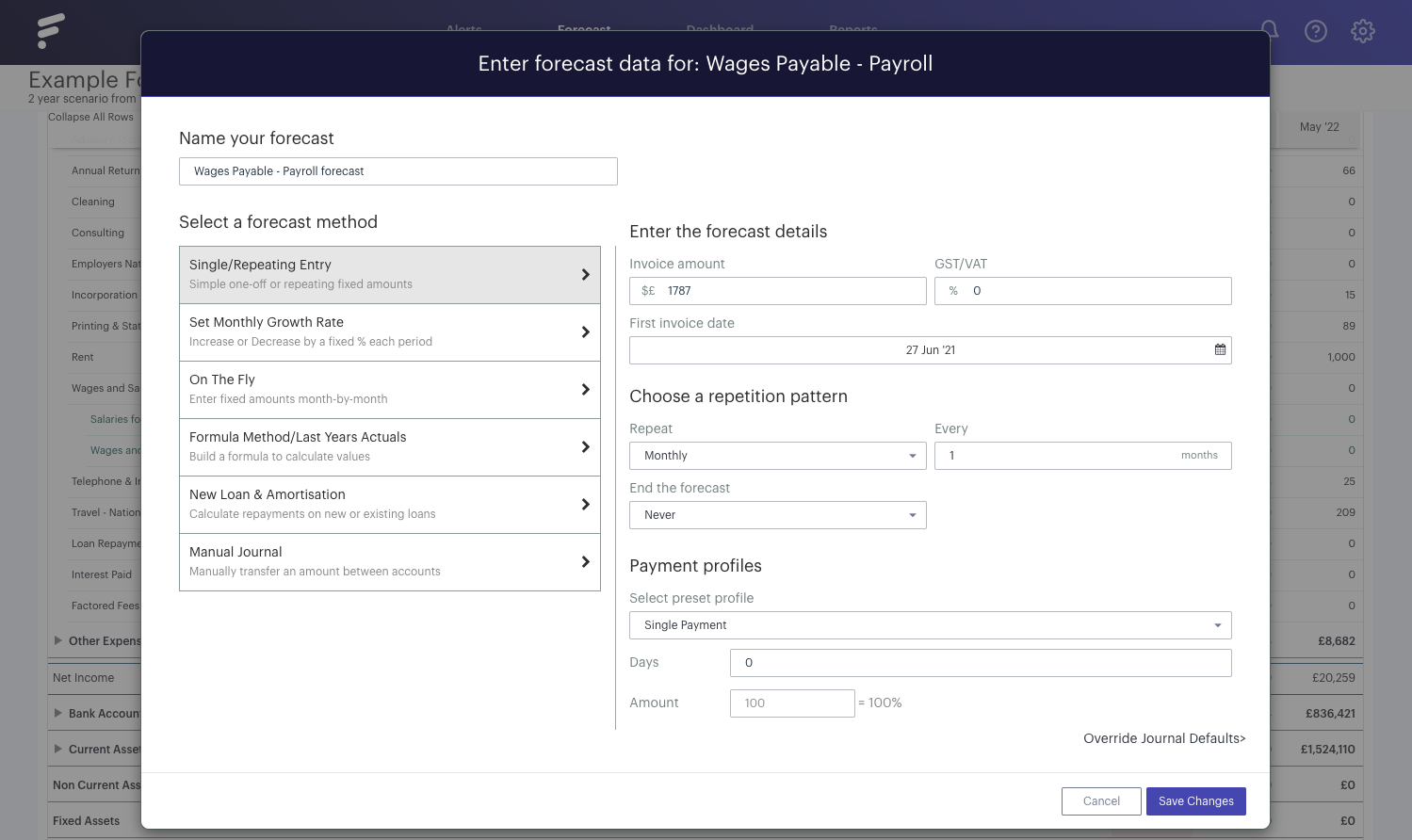

We’re now going to enter Sally’s net wages payments. Sally receives £1,787 on the 27th of each month. To record this, we’re going to create a new forecast item against our wages payable and then use the 'Single/Repeating Entry' method to enter this as a monthly recurring outgoing:

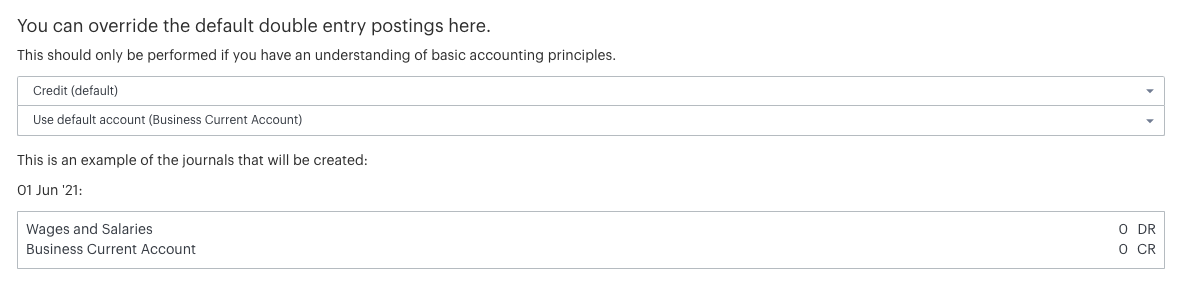

Using the 'Override Journal Defaults', we’re going to enter this as a credit and then hit 'Save Changes':

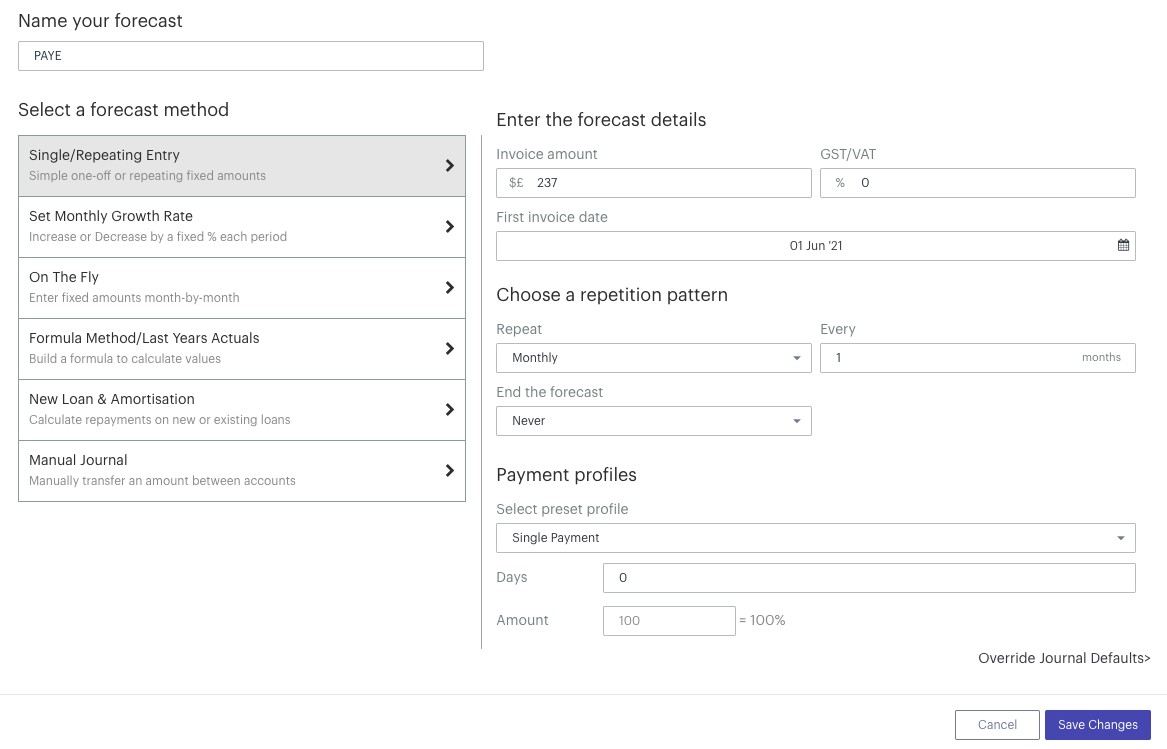

Next, we’re going to move the increases in PAYE and NI contributions out of our 'Wages Payable' account and into the appropriate balance sheet line. We can do this by creating two forecast items against our 'Wages Payable' line. One which will credit our PAYE payable line £273 every month and one which will credit our NIC payable line £189:

Once again we will be using the 'Override Journal Defaults' option to enter these as 'No Cash'.

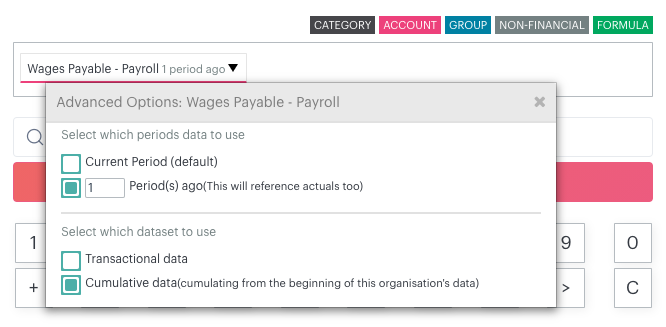

In our final step we now need to enter the payments of National Insurance and PAYE. We’re going to do this using the 'Formula Forecast' method so that we can automatically pay the balance of the line the previous month, the following month, in accordance with our payment terms. We’re going to do this by selecting the value of our account line the previous month using period offset. To do this select the appropriate balance sheet line from your chart of accounts, in this case, PAYE Payable and then click the arrow adjacent to the line. Select a period offset of one period:

Next we’re going to enter our payment terms and then use our Manual Journal Override to enter this as a credit rather than a debit:

Select 'Save Changes' and then repeat this step for National Insurance.